Market commentary

Positive momentum within the CML market has broadly continued in the third quarter of 2024. While CML activity levels have been increasing for several months as general market conditions have improved, the 10-year Treasury experienced a 74 basis-points (bps) drop in the third quarter. After a series of rate hikes starting in March 2022, the Fed enacted its first cuts of this cycle, reducing rates by 50 bps in September. These moves became a significant motivator to market participants who were previously more complacent. Concurrently with the declining Treasury, the spreads for corporate bonds have marginally tightened. CML spreads remain in the 140 to 170 bps range, although there has been an increasing number of sub- 140 spreads as lenders compete for top-tier business.1

Multifamily valuation rollercoaster at an end

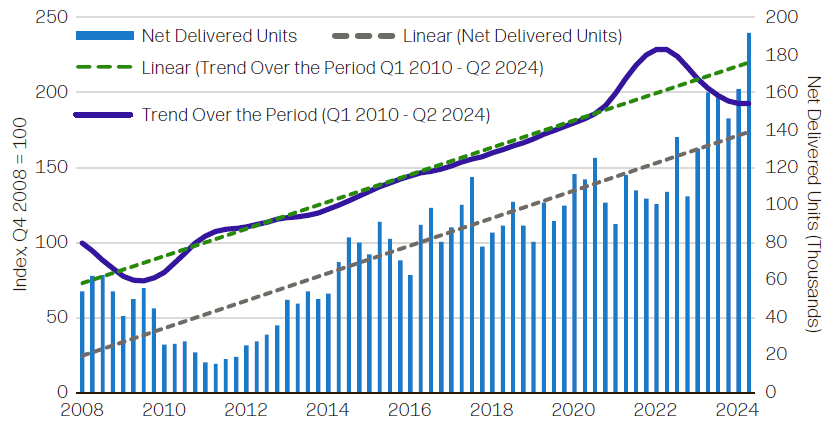

After years of positive, stable growth, the multifamily sector experienced a period of exuberance in 2020-2022. This trend has now reversed, and we believe the bottom has been reached with multifamily vacancy and inventory growth at cyclical highs and rent growth establishing a low point. Following a steady upward trajectory after the valuation troughs of the Global Financial Crisis, the multifamily sector experienced a sugar rush following the onset of Covid. From 2020 to 2022, valuations rose 27%, fueled by low interest rates and favorable demand fundamentals. As of Q3 2024, multifamily valuations have declined by 16% from their 2022 peak (Exhibit 1), primarily due to the higher inflation and interest rate environment over the past two years, coupled with a significant influx of new supply coming online.

Exhibit 1: Multifamily valuations have declined 16% from 2022 peak

Source: CoStar and Federal Reserve – 3 Month Moving Average of Hourly Wage Growth as of September 30, 2024

Nationally, as of the end of 3Q 2024, the multifamily vacancy rate is at 7.8%, up 0.5% year-on-year (YoY) and well above the 2021 low of 4.8%. The increase has been most pronounced in higher-end properties, which are currently 11.3% vacant, as they compete with new deliveries, while stabilized properties are 6.0% vacant. Rents are up 1.1% YoY at a national level. While far from the post-Covid highs of 9.9% in the first quarter of 2022, a bottom has appeared with YoY gains of around 1% for four consecutive quarters. The climbing vacancy rate and muted rent growth have been aided by a surge in new deliveries, culminating in quarterly deliveries of 192k units in Q2 2024, well above the average of 88k units per quarter from 2014-2019 (Exhibit 1).

We believe we are at a market trough. Per CoStar, vacancy rates are expected to peak in the first quarter of 2025 and then begin a steady decline as the market continues its digestion of new supply.2 Rent growth has now hovered around 1% for a year and is expected to increase to 3.8% by the third quarter of 2025 with YoY rates of 3%+ forecasted until 2028. Most importantly, deliveries should begin a rapid decline in 2025 and are forecasted to average 77k units per quarter for the next two years. Optimism now seems warranted. Stress may appear in 2020 to 2022 acquisitions, which used very bullish assumptions and were financed with very low coupon debt. However, investors have taken note with new funds being raised to capitalize on this stress, which should help to limit downside and further help establish a bottom to valuations. We believe thoughtfully underwritten transactions should continue to perform well, and the future appears bright.

1 Aegon Asset Management. September 30, 2024

2 CoStar. September 26, 2024

Download Article

Disclosures

This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for institutional and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM stakeholders.

This document is for informational purposes only in connection with the marketing and advertising of products and services, and is not investment research, advice or a recommendation.

It shall not constitute an offer to sell or the solicitation to buy any investment nor shall any offer of products or services be made to any person in any jurisdiction where unlawful or unauthorized. Any opinions, estimates, or forecasts expressed are the current views of the author(s) at the time of publication and are subject to change without notice. The research taken into account in this document may or may not have been used for or be consistent with all Aegon AM investment strategies. References to securities, asset classes and financial markets are included for illustrative purposes only and should not be relied upon to assist or inform the making of any investment decisions. It has not been prepared in accordance with any legal requirements designed to promote the independence of investment research and may have been acted upon by Aegon AM and Aegon AM staff for their own purposes.

The information contained in this material does not take into account any investor's investment objectives, particular needs, or financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of the recipient. Investors should consult their investment professional prior to making an investment decision. Aegon Asset Management is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon Asset Management nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above.

Past performance is not a guide to future performance. All investments contain risk and may lose value. Commercial Mortgage Loans are subject to risks such as credit, interest rate and operational risk and may not be suitable for all investors. This document contains "forward-looking statements" which are based on Aegon AM's beliefs, as well as on a number of assumptions concerning future events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and returns may differ materially from statements set forth herein.

The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned subsidiary of Aegon Ltd. Aegon AM US and Aegon RA are both US SEC registered investment advisers.

©2024 Aegon Asset Management or its affiliates. All rights reserved.

AdTrax: 5784527.8

Expiration Date: March 31, 2025