It’s been a busy and productive month and half since our last update. Non-QM origination volumes continue to scale and spreads across both whole loans and RMBS tightened into continued strong demand for product. At SG we had record lock volumes in May and in talking with clients and other market participants, it seems like volumes were strong industry wide. Last month we were with a couple thousand other mortgage market participants in Times Square for the annual MBA Secondary conference. It was interesting to see how Non-QM has evolved into a focal point for the conference. From an originator’s perspective, Non-QM offers a welcome growth opportunity versus the traditional GSE origination business. We came away from the conference with the belief that the sector can continue to grow, even absent a move lower in rates. Originators already active in the space are devoting more resources toward the product and there’s still a number of originators just getting started in Non-QM.

Both securitization and Insurance demand remains strong. $17BN of Non-QM RMBS has been issued YTD, making it the largest sector in RMBS by a significant margin. Non-QM RMBS spreads continue to grind tighter with AAAs now inside of 130. Loan spreads have tightened with securitization and insurance demand, but still provide compelling risk-adjusted returns in our view. We estimate Insurance portfolios remain the end buyer for greater than 50% of monthly production. As we’ve covered before, insurance activity in the space largely fits into two categories. A handful of large historically active insurance portfolios have built out their own infrastructure and actively trade directly with originators, aggregators, and the street. Away from these portfolios, we see a growing number of insurance companies accessing the market by partnering with investment managers who are already active in the loan space. Based on our conversations, we expect this trend to continue for the next several years. So, if you are contemplating exposure to the sector, you’re not too late and we are positioned to help.

| Asset |

23-Dec |

24-Jan |

24-Feb |

24-Mar |

30-Apr |

31-May |

10-Jun |

YTD |

| 5YR UST |

3.85 |

3.84 |

4.25 |

4.21 |

4.62 |

4.51 |

4.48 |

0.63 |

| HY CDX |

354 |

350 |

340 |

330 |

352 |

333 |

334 |

-20 |

| SPY |

475 |

483 |

508 |

523 |

513 |

527 |

535 |

13% |

| Non-QM AAA |

155 |

150 |

145 |

135 |

135 |

130 |

125 |

-30 |

| Non-QM BBB |

320 |

275 |

245 |

230 |

230 |

220 |

215 |

-105 |

| Non-QM Loan Spread |

365 |

325 |

295 |

280 |

280 |

275 |

270 |

-95 |

| Non-QM Loan GWAC |

8.63 |

8.50 |

8.375 |

8.15 |

8.15 |

8.10 |

8.05 |

-0.57 |

| Freddie PMMS |

6.61 |

6.69 |

6.94 |

6.79 |

6.85 |

7.03 |

6.99 |

0.38 |

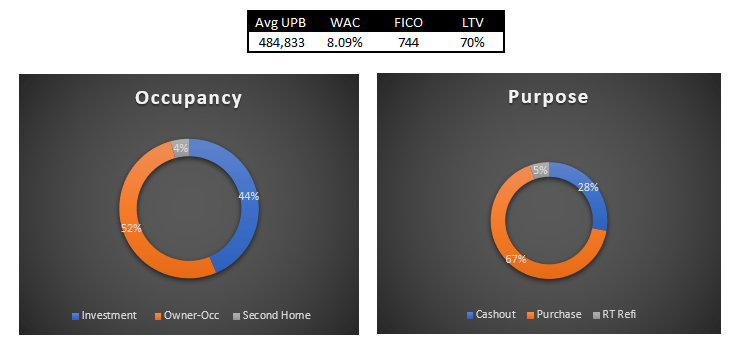

Non-QM credit quality continues to be strong. Our production stats for May fundings are below. We believe 8+% coupons for prime quality borrowers with 30% home equity represents a compelling investment opportunity.

At Shelter Growth, our focus continues to be delivering clients a turn-key solution for residential loan investing. Our customizable solutions offer clients an efficient and attractive way to access residential loan investing. Please let us know how we can help.

Best Regards,

The Shelter Growth Team