Executive Summary:

- An appraisal valuation is the best guess of the value a private asset would fetch in an orderly sale. Appraisal valuations tend to change at a slower pace than traded equity valuations, making traditional risk measurements less effective.

- In this paper, we examine three methodologies that asset managers typically use to measure appraisal valuations: observed volatility, statistical desmoothing and public market proxies.

- Leveraging these methodologies, we believe that the balance of evidence suggests that even a modestly diversified portfolio of private equity funds has volatility similar to that of listed equities.

In volume one of our series on portfolio construction, we introduced what we believe are the three key building blocks of private markets portfolio construction. In volume two, we examined the first of those blocks: measuring and estimating returns. In this humble volume, we will tackle a topic that is sure to get you uninvited from most cocktail parties, family gatherings, first dates and DnD campaigns (among others):

The problem with private equity risk

Our earlier volumes summarized the challenges with creating a private markets framework – chiefly, data opacity and disagreement over how to measure key portfolio attributes. Those challenges are most acute in the realm of risk assessment.

Let’s set the data challenge aside for the moment – we’re fortunate to have one of the industry’s largest and highest quality datasets – and focus on measuring sticks. Private assets are valued infrequently (occasionally monthly, usually quarterly, sometimes semiannually or annually) and are valued on an appraisal basis. In other words, an appraisal valuation is the best guess of the value the asset would fetch in an orderly sale of the asset. Think of it as the Zillow “Zestimate” of the value of your neighbor’s house that you and I both know that you’re stalking (admit it). This is by necessity since privately held companies may only change hands every five to six years.

This stands in stark contrast to listed assets, which have observable, transaction-based prices (the price at which an asset actually changes hands) available by the millisecond. Traditional risk measurement techniques are designed with these characteristics in mind.

It's well-documented that infrequent appraisal valuations tend to change at a slower pace than traded equity valuations. Cynics would argue that GPs are either lazy and simply anchor their current valuation to a previous valuation or are “volatility laundering.” A more realistic view is that large changes to valuations are tied to material changes in financial position of the asset (e.g., winning a large new contract, a successful product launch, the full implementation of cost controls, etc.), overwhelming changes in the valuation environment (e.g., comparable assets being sold at substantially higher / lower valuation multiples) or visibility on exit price. These are low-frequency events that may occur over the span of several quarters.

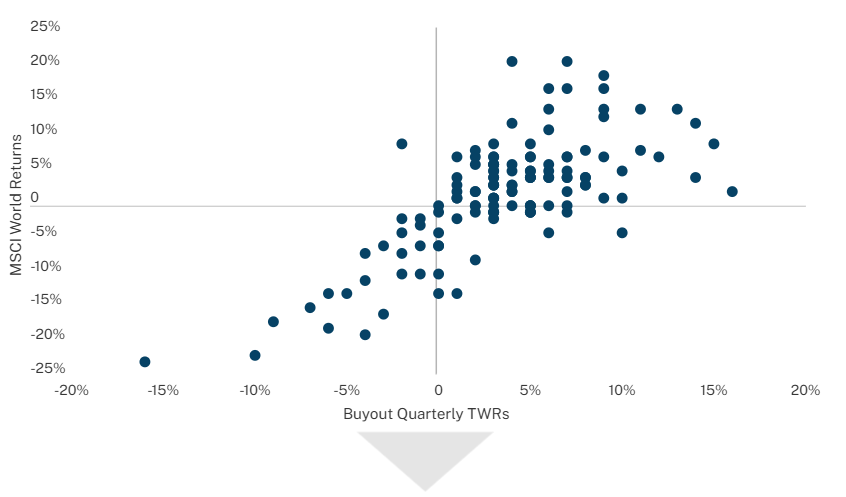

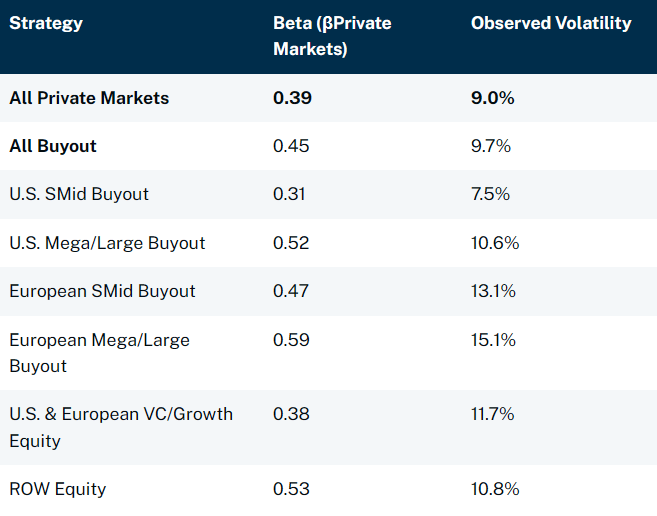

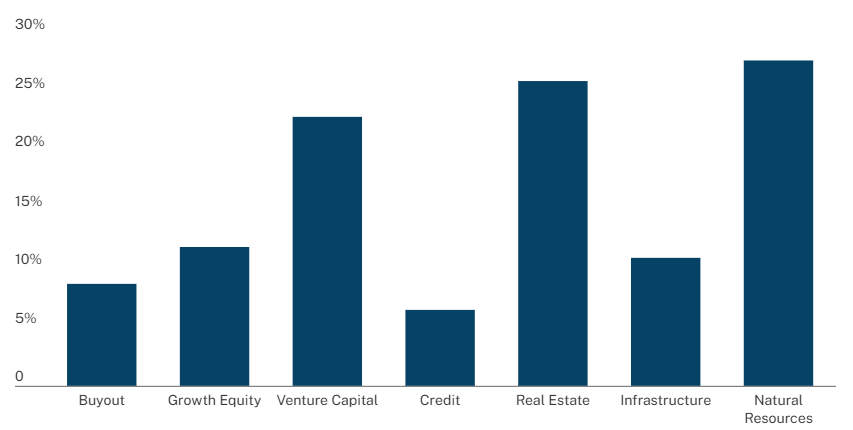

This means that applying traditional risk measurement techniques to private equity can – depending on your point of view – yield some interesting results. Below we summarize the observed standard deviation of quarterly returns for several private equity sub-strategies and compare them to the same metric for listed benchmarks. The “smoothing” effect of appraisal values in private equity is clear.

Buyout vs. MSCI World Quarterly TWRs

Source: Hamilton Lane Data via Cobalt, Bloomberg (April 2024)

The results may seem counterintuitive to anyone who’s picked up a corporate finance textbook. Aren’t these equity assets? (Yes.) How could private equity assets possibly have fixed income-level risk? (We don’t think they do.) And since, after all, private equity investors are just leverage merchants, shouldn’t the volatility be higher than listed equity volatility? (It’s complicated!)

Options

The quirks of using quarterly returns to estimate private equity risk has sprouted a cottage industry of providers offering “better” estimates of the “economic” or “intrinsic” risk of private equity. It’s also sparked intense debate among private equity researchers. If you find yourself at a bar full of private equity researchers and are in the mood for some excitement, ask the crowd what they think the beta of private equity is. You’ll be treated to a scene right out of “Road House.”

While we can’t offer you a beer or the prospect of fisticuffs, we can quickly walk through some of the methods for estimating the economic risk of private equity.

We like observed volatility just fine, thank you.

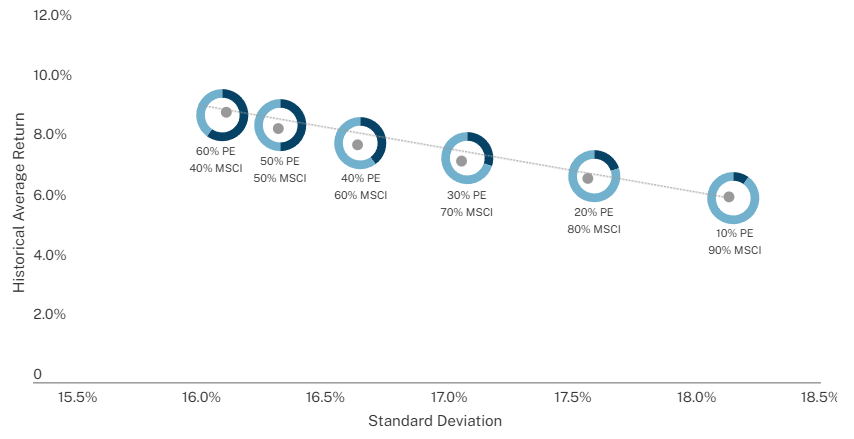

While most researchers view private equity volatility as a riddle that must be unraveled, there is a subset of investors that view the smoothing effect as a feature rather than a bug. Historical data on observed returns and volatility would suggest that adding private equity to your portfolio would have increased returns and lowered risk despite a relatively healthy correlation with listed assets. That is a compelling data point to show your stakeholders!

Risk vs. Return by Portfolio Mix – Observed Volatility

Source: Hamilton Lane Data via Cobalt, Bloomberg (October 2024)

Those on Team Observed Volatility would argue that the observed volatility corresponds to the same values that they are using in the reports and return calculations for their portfolio. It is representative of the ride they are experiencing and, in the absence of a well-established “better” way to estimate risk, they should stick to the accounting. It is reasonably possible that the price for a control stake, negotiated by highly informed financial buyers with privileged information over the course of months may not move as much (or in the same way) as the price of instantaneous liquidity for fractional shares (minority positions) among a disparate group of buyers and intermediaries.

There are bits of truth to that argument (particularly the last piece). We find it slightly more compelling for semi-liquid private equity vehicles, which offer regular subscriptions and redemptions and the prevailing valuation. Well-managed vehicles that can deliver on that liquidity promise are offering a price that investors are transacting at, making the observed volatility more comparable to the volatility of the listed assets.

But there are limits to the volume of liquidity on offer, as some investors have learned the hard way. So, we’re not sold on using the observed volatility, especially for more “traditional” private equity investments.

Statistical desmoothing

We broadly define “statistical desmoothing” as the application of mathematical techniques to private equity cash flows and / or valuations to adjust for the “smoothing” effect of appraisal valuations. These methods are popular among private equity researchers like us since they give us a chance to flex our quantitative muscles and justify our continued employment 😊. But the real reason we like this family of methodologies is that they maintain some linkage to the experience of the LP, since statistical desmoothing estimates are often derived directly from the cash flows that LPs experience. We believe that statistical desmoothing techniques can produce better estimates of “economic” risk.

We see two caveats for using statistical desmoothing. First, methodologies linked to private equity cash flows typically call for using the cash flows of liquidated investments only. Given the long life of many private equity investments (e.g., asset level hold periods are over five years and many modern private equity funds live into their teenage years), this precludes recent investments from inclusion in risk estimates. This can be problematic if there is style drift over time and for estimating the risk of nascent private markets strategies (like senior credit and infrastructure).

Second, statistical desmoothing techniques can be complex, making them challenging to both implement and articulate to stakeholders and key decision makers who do not spend their days developing regression models. This is an underappreciated practical challenge by quantitative researchers.

Some techniques are more advanced than others: They can range from relatively simple arithmetic to more advanced stochastic methods.

One of the early (but still popular) methods of desmoothing was developed by David Geltner for evaluating the risk of illiquid real estate investments. Geltner developed what we call a “single period autocorrelation” model. In simple terms that means:

- Geltner observed that the current quarter’s (Q) valuation movement tends to be anchored to the previous quarter’s (Q-1) valuation movement. In other words, valuations were gradually updated over time.

- The relationship between Q and Q-1 can be quantified by calculating the correlation of the time series of quarterly returns with itself lagged by one quarter. This is called the autocorrelation coefficient.

- We can use the autocorrelation coefficient and some simple algebra to remove the influence of Q-1 on Q for each Q in the time series. The resulting time series is the “desmoothed” time series.

- The desmoothed time series can be used to calculate volatility and other risk metrics.

Geltner’s method has the advantage of being both intuitively pleasing and simple enough for a first-year analyst to calculate in an Excel spreadsheet. As you would expect, risk estimates using the Geltner methodology push most strategies further out on the risk spectrum.

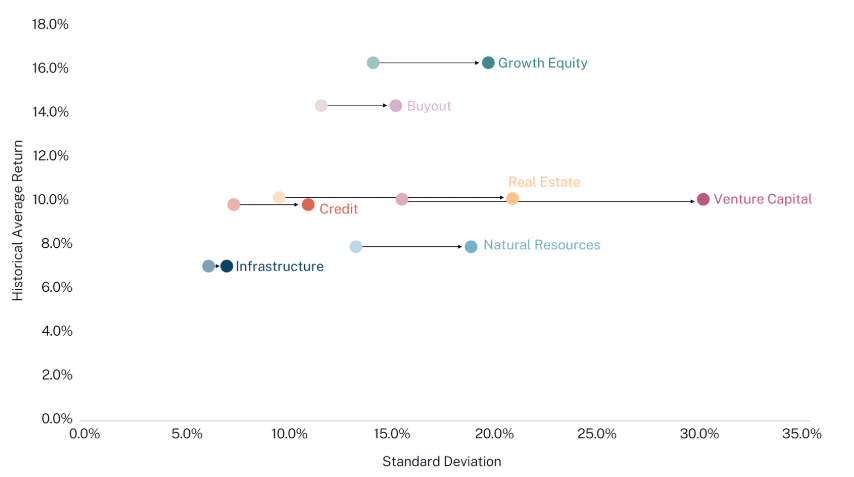

Risk vs. Return by Strategy – Geltner Desmoothed Volatility

Source: Hamilton Lane Data via Cobalt (October 2024)

Importantly, some strategies experience larger volatility adjustments than others. For example, venture capital experiences a nearly +15% increase in volatility. Other strategies, such as credit and infrastructure, experience smaller changes. This means that the impact of this methodology is not uniform.

A good example of a more advanced method is based on work pioneered by Korteweg and Nagel. The details are too complex to outline in this already-too-long paper, so we’ll link the paper here for interested readers. It makes for good bedtime reading for the newly minted PhD you just hired. We will use some space to share the results of applying that methodology to our dataset below:

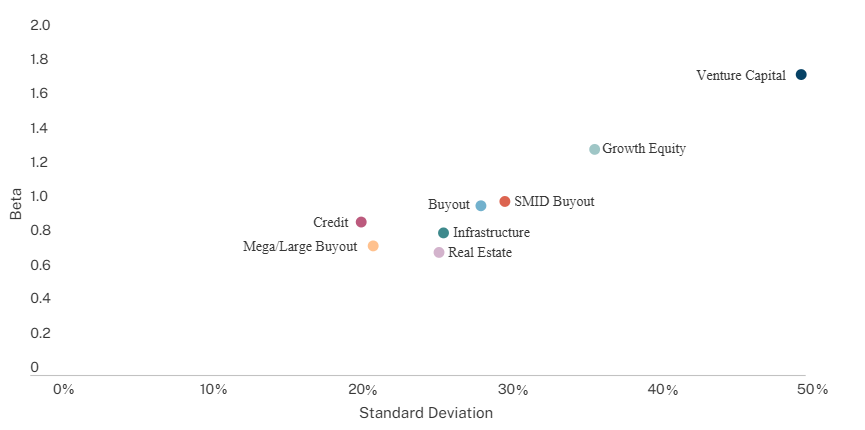

Total Risk and Beta by Strategy

Substantially Liquidated Funds

Source: Hamilton Lane Data via Cobalt (February 2022)

The volatility estimates under this methodology are generally higher than under the Geltner methodology. Much of this is idiosyncratic volatility since the beta estimates are clustered around one (with the glaring exception of venture capital). Two very important methodological caveats: This methodology eschews interim valuations and relies solely on cash flows to derive its estimates. So, we can only feed the algorithm data from liquidated or substantially liquidated funds. This means that funds from newer vintage years cannot be used.

The risk estimates represent the average, single fund for a strategy. A portfolio is usually made up of several funds made over time. Applying this methodology to portfolios of funds will yield lower risk estimates since portfolios of funds naturally have lower idiosyncratic risk.

As you’ve no doubt gathered from the examples above, statistical desmoothing tends to produce higher estimates of volatility than what is suggested by the observed valuations. In many cases, the volatility and beta estimates converge on something a bit higher than listed equity volatility and betas slightly above one for buyout strategies. But those results can vary widely depending on the specifics of the methodology and the dataset to which the methodology is applied. Pay careful attention to the methodology for these studies: Many studies seek to estimate the risk of the median private equity fund. That is a useful datapoint, but investors typically invest in several funds per year. We would argue that the risk profile of a portfolio investing in several funds per year is much different than the risk profile of a single private equity fund. More on that later.

Public market proxies

The intuition behind public market proxies is sensible: Let’s find a pool of listed assets that look and feel the most like private equity assets. We can make sure that pool has the right sector weights, similarly sized companies, exposures to certain risk factors (e.g., Fama-French factors) and add a bit of leverage on top to account for the generally higher leverage in private markets. Voila, we now have a custom index that we can plug into our typical risk calculators as a proxy for private equity.

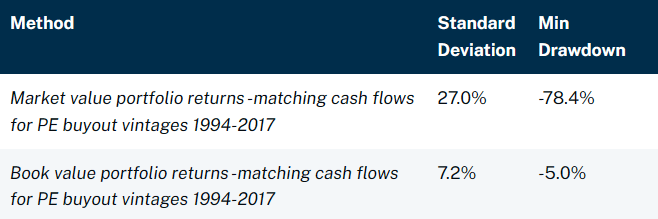

Arguably the most well-known paper on the topic was written by Professor Erik Stafford in 2016. Stafford argued that private equity returns could be proxied with small-cap, sector-adjusted value stocks. The coincident volatility estimates are substantially higher than the observed (“book value”).

Stafford (2016) Public Market Proxy Risk Results

Source: Stafford, Erik, Replicating Private Equity with Value Investing, Homemade Leverage, and Hold-to-Maturity Accounting (September 18, 2020).

As you may have guessed, public market proxy methods tend to produce very high estimates of volatility. After all, most proxies – at their core – are portfolios of levered small-cap stocks. Small-cap stocks are volatile, and the additional leverage serves to amplify that. For those using CAPM to draw efficient frontiers, these exaggerated levels of volatility will put natural limits on the size of the private equity allocation since there is now a corresponding volatility premium to go along with the return premium.

While these methodologies have a satisfying intuitive simplicity, there are a few problems. First, the characteristics of private equity investments may change over time. Sector weights may change, managers may shift to a preference for growth over value, etc. This can be challenging to sense in real time. Second, these estimates can be a step further removed from the underlying experience (the cash flow stream) of private equity investors. Third, many of these methods add leverage on top of the basket of publicly listed companies, which is misaligned with how leverage is used in private equity. Finally, these proxies ignore certain measures and safety nets that PE-backed companies have at their disposal. For example, a private equity manager has the flexibility to call additional capital from LPs to cure capital structure issues at one of its portfolio companies. This sort of safety net is not as readily available to listed companies.

Other ways to look at risk

The more technical definition of risk is the probability of something other than expectation occurring. But most investors are only concerned with the probability that something worse than expectation will occur – positive surprises are usually happy surprises (although, as some investors learned in 2022, positive surprises can lead to overallocation, which creates its own set of issues). What they really want to know is, “What is the chance that something bad will happen and I will be cross-examined by my stakeholders about the bad thing?”

The most obvious bad thing is losing money over some reasonable time horizon. Losing money will annoy your stakeholders! It is usually considered better to have more money than less. We can look at loss ratios to tell something about the probability that we lose some of our principal.

Fund Loss Ratios by Strategy

Source: Hamilton Lane Data via Cobalt (as of June 2024).

Footnote: Infrastructure vintage years included are 2006-2020. All other strategies are fund vintage years 2000-2020.

Fund-level loss ratios generally follow intuition: Loss ratios in strategies like credit (perceived as less risky) are lower than loss ratios in strategies like venture capital (perceived as riskier). This also follows the relative volatility relationships shown above. In general, fund-level loss ratios are relatively low, and the instances of total fund write-offs have been rare. For example, the percentage of buyout funds that have lost money is less than 9%.

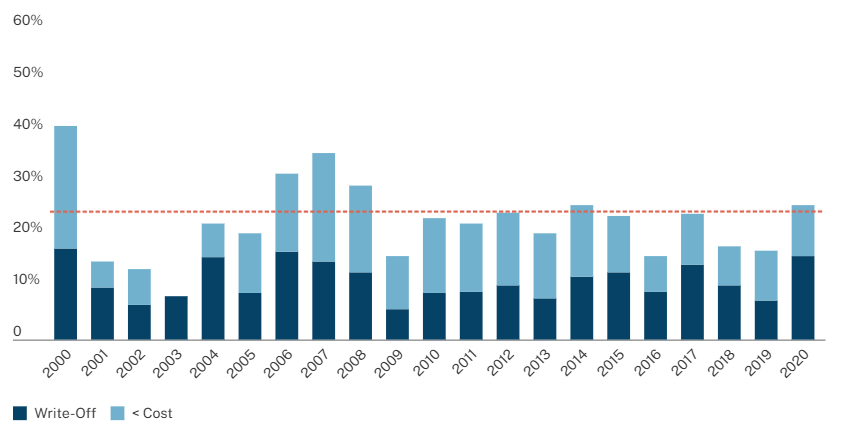

That picture changes slightly at the deal level:

Loss Ratio of Realized Buyout Deals

% of Deal Count

Source: Hamilton Lane Data via Cobalt (October 2024)

Loss ratios for individual deals are much higher and when there is a loss it is often a write-off. Seasoned co-investors are well-aware of this dynamic and plan accordingly. But this has been a pitfall for “co-investment tourists,” who naively size a small, scattershot crop of co-investment positions as the same as fund positions. This can add tremendous idiosyncratic risk to the portfolio given the higher risk of loss for deals relative to funds.

(It is worth noting that GPs seem well-aware that LPs look at deal loss ratios during fund diligence, creating an incentive for them to minimize loss ratios. Greg Brown recently authored a fascinating paper on the topic.)

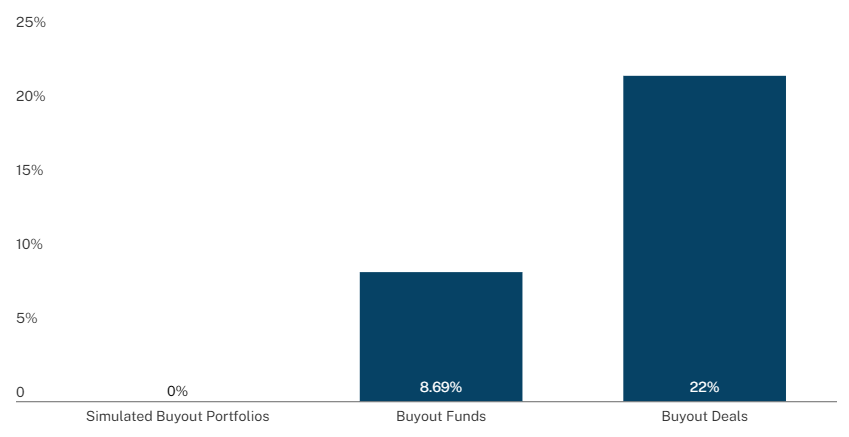

Buyout Loss Ratios

Source: Hamilton Lane Data (October 2024). Buyout portfolios based on 100,000 simulations of investing in 4 buyout funds/year from 2004-2022. Buyout funds and deals include vintages 2000-2020

What about at the portfolio level? Portfolios are a collection of funds and assets, so we’d expect them to have even lower loss ratios than funds or deals. And data has confirmed as much: Historically, it has been easier to affably complete a game of Risk at family gatherings than lose money on a private equity portfolio. Even investing in only one fund per year, the bare minimum for diversification, the risk of loss nearly evaporates. Private assets, funds and portfolios can have long lives, perhaps longer than many investors’ stints at their employers. The stakeholders (and compensation committees) for many private equity investors will often look at short- and intermediate-term performance as a gauge of success. So, from a risk perspective, the worst-case performance over some intermediate period can be an informative risk metric. Here, we show the worst-case outcomes over any five-year period, roughly the average hold period / duration of the underlying assets.

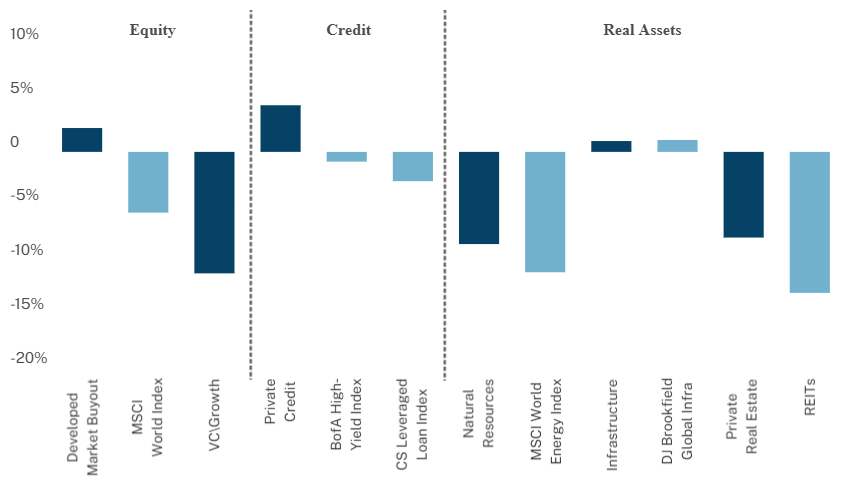

Lowest 5-Year Annualized Performance

Infrastructure from 2011 -2024, Natural Resources from 1998 -2024. Source: Hamilton Lane Data via Cobalt, Bloomberg (October 2024)

These figures give further credence to the relative riskiness of the strategies within private markets: The most pronounced drawdown occurred in venture capital while credit and infrastructure actually produced positive returns in their worst-case five-year scenarios (buyout funds are also surprisingly in that cohort).

What does it all mean?

If you made it all the way here you may be feeling like most people that watched “Tenet”: You saw some compelling scenes, it went on a bit too long and the plot mechanics were confusing (temporal pincer anyone?). But guess what: That movie brought in $365M in revenue. Perhaps this paper will bring in $365M in revenue as well.

For those who don’t want to spend their limited free time thinking about details of reverse entropy, we offer a short summary of our interpretation of the data above:

- Take the observed / reported volatility figures with a grain of salt. Yes, those are the figures on the financial statements, but they may not be a reliable indicator of “intrinsic” or “economic” volatility.

- We believe the balance of the evidence suggests that even a modestly diversified portfolio of private equity funds has volatility similar to that of listed equities. Buyout funds likely have a beta a bit above one (vs. ~0.4 on an observed basis).

- But there are differences by strategy, most of which follow intuition. We believe most types of private credit (at least the loan origination strategies) are less risky than private equity strategies. Venture capital, on the other hand, is substantially more volatile than listed counterparts. The jury is still out on some newer strategies with short histories.

- Deal risk < fund risk < portfolio risk. I know, another “Thanks, Captain Obvious” moment in this series. But the actions of some co-investors suggest that this is often forgotten in the excitement of closing The Next Hot Deal. LPs should carefully consider their co-investment (and secondaries!) strategy to avoid inadvertently altering the risk profile of their portfolio. While volatility is the default way to assess risk, it does not explicitly account for another major risk private equity investors face: liquidity risk.

Stay tuned for more on our last building block of portfolio construction in the next paper in this series…

Disclosures

This document has been prepared solely for informational purposes and contains confidential and proprietary information, the disclosure of which could be harmful to Hamilton Lane. Accordingly, the recipients of this document are requested to maintain the confidentiality of the information contained herein. This document may not be copied or distributed, in whole or in part, without the prior written consent of Hamilton Lane.

There are a number of factors that can affect the private markets which can have a substantial impact on the results included in this analysis. There is no guarantee that this analysis will accurately reflect actual results which may differ materially. These valuations do not necessarily reflect current values in light of market disruptions and volatility experienced in the fourth quarter of 2020, particularly in relation to the evolving impact of COVID-19, which is affecting markets globally.

The information contained in this presentation may include forward-looking statements. Forward-looking statements include a number of risks, uncertainties and other factors beyond our control which may result in material differences in actual results, performance or other expectations. The opinions, estimates and analyses reflect our current judgment, which may change in the future.

All opinions, estimates and forecasts contained herein are based on information available to Hamilton Lane as of the date of this presentation and are subject to change. The information included in this presentation has not been reviewed or audited by independent public accountants. Certain information included herein has been obtained from sources that Hamilton Lane believes to be reliable but the accuracy of such information cannot

be guaranteed.

This presentation is not an offer to sell, or a solicitation of any offer to buy, any security or to enter into any agreement with Hamilton Lane or any of its affiliates. Any such offering will be made only at your request. We do not intend that any public offering will be made by us at any time with respect to any potential transaction discussed in this presentation. Any offering or potential transaction will be made pursuant to separate documentation negotiated between us, which will supersede entirely the information contained herein.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations. You should consult your accounting, legal, tax or other advisors about the matters discussed herein.

Hamilton Lane (UK) Limited is a wholly-owned subsidiary of Hamilton Lane Advisors, L.L.C. Hamilton Lane (UK) Limited is authorized and regulated by the Financial Conducts Authority. In the UK this communication is directed solely at persons who would be classified as a professional client or eligible counterparty under the FCA Handbook of Rules and Guidance. Its contents are not directed at, may not be suitable for and should not be relied upon by retail clients.

Hamilton Lane Advisors, L.L.C. is exempt from the requirement to hold an Australian financial services license under the Corporations Act 2001 in respect of the financial services by operation of ASIC Class Order 03/1100: U.S. SEC regulated financial service providers. Hamilton Lane Advisors, L.L.C. is regulated by the SEC under U.S. laws, which differ from Australian laws. The PDS and target market determination for the Hamilton Lane Global Private assets Fund (AUD) can be obtained by calling 02 9293 7950 or visiting our website www.hamiltonlane.com.au.

Hamilton Lane (Germany) GmbH is a wholly-owned subsidiary of Hamilton Lane Advisors, L.L.C. Hamilton Lane (Germany) GmbH is authorised and regulated by the Federal Financial Supervisory Authority (BaFin). In the European Economic Area this communication is directed solely at persons who would be classified as professional investors within the meaning of Directive 2011/61/EU (AIFMD). Its contents are not directed at, may not be suitable for and should not be relied upon by retail clients.

As of October 29, 2024