In Performing Credit Quarterly 2Q2024: The Dual Economy, we wrote about mixed economic signals frustrating the U.S. Federal Reserve’s ability to act decisively on monetary policy. After being – incorrectly – priced in multiple times over the past year, the first interest rate cut finally came in September, marking the end of the Fed’s hiking cycle. As we discuss below in Credit Markets: Key Trends, Risks, and Opportunities to Monitor in 4Q2024, this may unlock new M&A and LBO activity, generating more loan supply for the public debt and direct lending markets, both of which are hungry for new-money issuance. While the leveraged finance markets continue to readily absorb newly issued corporate loans, one less familiar area of the credit markets – asset-backed finance – faces a potential financing void.

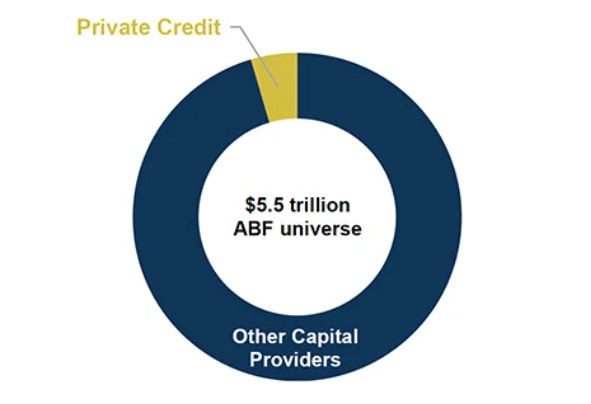

Alternative capital providers supplanting traditional lenders is now a familiar tale. Banks, facing heightened capital regulations following the Global Financial Crisis, retrenched from corporate lending, effectively launching direct lending as a mainstream asset class. As traditional lenders face further headwinds, we believe the next chapter in the private credit story is the migration of asset-backed finance (ABF) toward alternative capital providers. While the asset class isn’t new – lending against contractual revenue streams has historically been a cornerstone of bank and insurance company activity – the fundamental transition lies in who now provides the capital. Asset-backed financing may become increasingly unfavorable for banks, and insurers generally stick to the investment grade corner of the ABF market. Even among private lenders, who are estimated to currently provide less than 5% of asset-back financing within the $5.5 trillion universe, there are still significant barriers to entry, with a complexity that mandates experience across corporate lending, real estate lending, and structured credit. (See Figure 1.)

Figure 1: Private Credit Involvement in ABF Is Nascent

Source: Oliver Wyman estimate1

Defining Asset-Backed Finance

A form of private credit, backed by pools of contractual assets (e.g., loans, leases, and mortgages), as opposed to individual companies.

Unlike standard corporate lending, ABF pays back principal continuously, rather than providing a large principal repayment at maturity.

Underlying assets in the ABF universe reflect the breadth of the global economy, ranging from aircraft leases to credit card receivables to music royalties.

Endnotes

1 Oliver Wyman, Private Credit’s Next Act, April 2024. The $5.5 trillion figure represents the U.S. asset-backed finance market, excluding real estate.

Download Article

Notes and Disclaimers

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. Responses to any inquiry that may involve the rendering of personalized investment advice or effecting or attempting to effect transactions in securities will not be made absent compliance with applicable laws or regulations (including broker dealer, investment adviser or applicable agent or representative registration requirements), or applicable exemptions or exclusions therefrom.

This document, including the information contained herein may not be copied, reproduced, republished, posted, transmitted, distributed, disseminated or disclosed, in whole or in part, to any other person in any way without the prior written consent of Oaktree Capital Management, L.P. (together with its affiliates, “Oaktree”). By accepting this document, you agree that you will comply with these restrictions and acknowledge that your compliance is a material inducement to Oaktree providing this document to you.

This document contains information and views as of the date indicated and such information and views are subject to change without notice. Oaktree has no duty or obligation to update the information contained herein. Further, Oaktree makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Oaktree believes that such information is accurate and that the sources from which it has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. Moreover, independent third-party sources cited in these materials are not making any representations or warranties regarding any information attributed to them and shall have no liability in connection with the use of such information in these materials.

© 2024 Oaktree Capital Management, L.P.