The start of the Fed’s easing cycle has raised the prospect of a recovery in commercial real estate (CRE) markets after a challenging period of elevated financing costs and pressure on valuations. But while there are signs of a nascent recovery for some of the more challenged parts of commercial real estate markets, there are still risks on the horizon as economic growth looks set to moderate and inflation concerns could persist heading into 2025.

Against this backdrop, we believe net lease can provide valuable portfolio ballast for commercial real estate allocations and attractive fixed income alpha given historically tight credit spreads today. As a real estate strategy, longer duration net leases typically produce steady and predictable cash flows while also protecting against increased macroeconomic volatility. As a fixed income substitute, net leases can offer enhanced yield and added safety in the form of physical collateral.

With the transition to the next phase of the economic cycle now underway, we see higher-than-usual uncertainty surrounding the destination for interest rates and the broader economic outlook. In this environment, we believe net lease can be a particularly interesting all-weather, economic cycle-agnostic strategy.

An Overview of Net Lease:

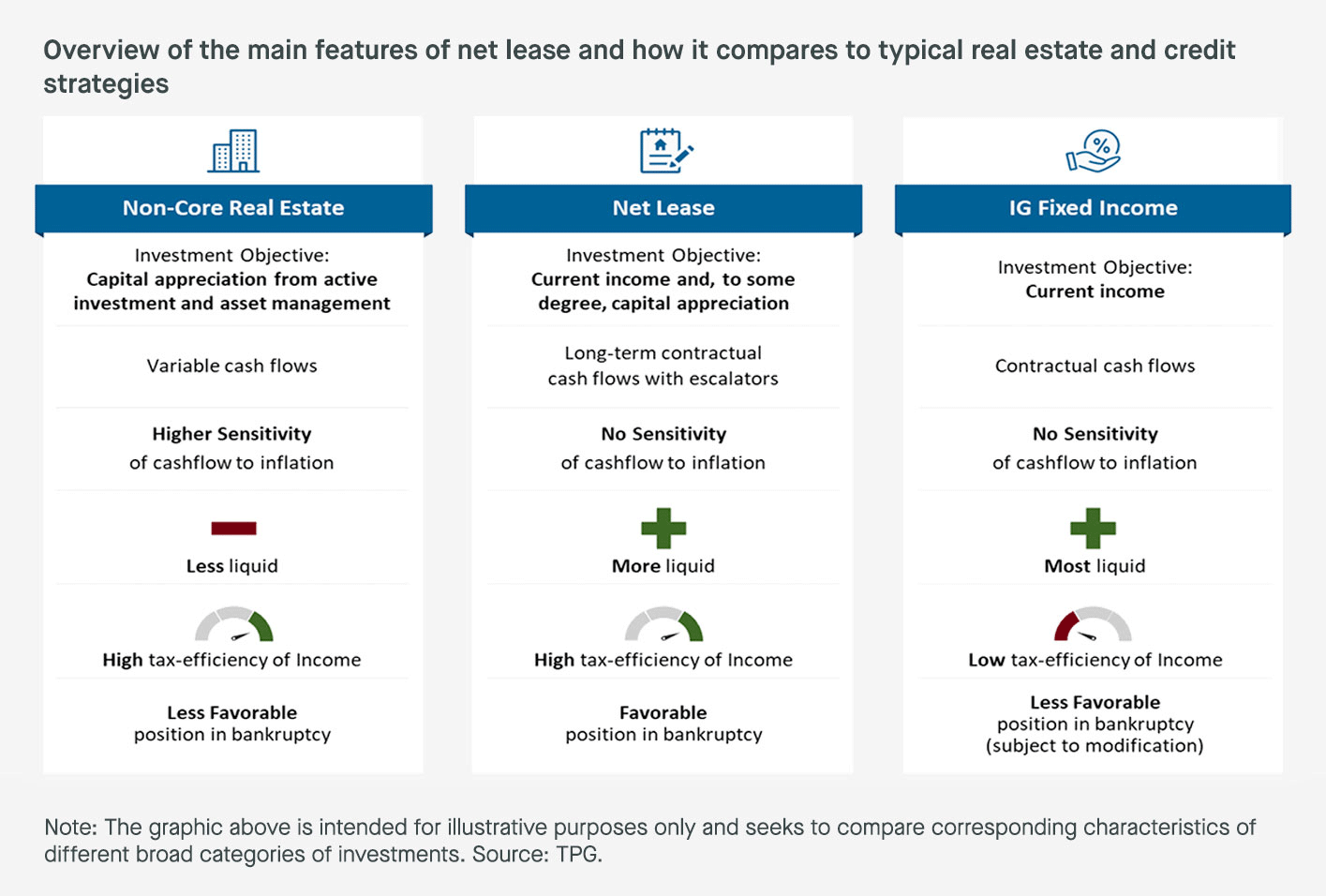

For corporate owners of real estate, sale-leasebacks represent an alternative source of financing, through which a corporation can monetize the fair market value of their real estate by first selling it and then leasing it back from the buyer. Fundamentally, net lease assets are part credit and part real estate investments (see Exhibit 1).

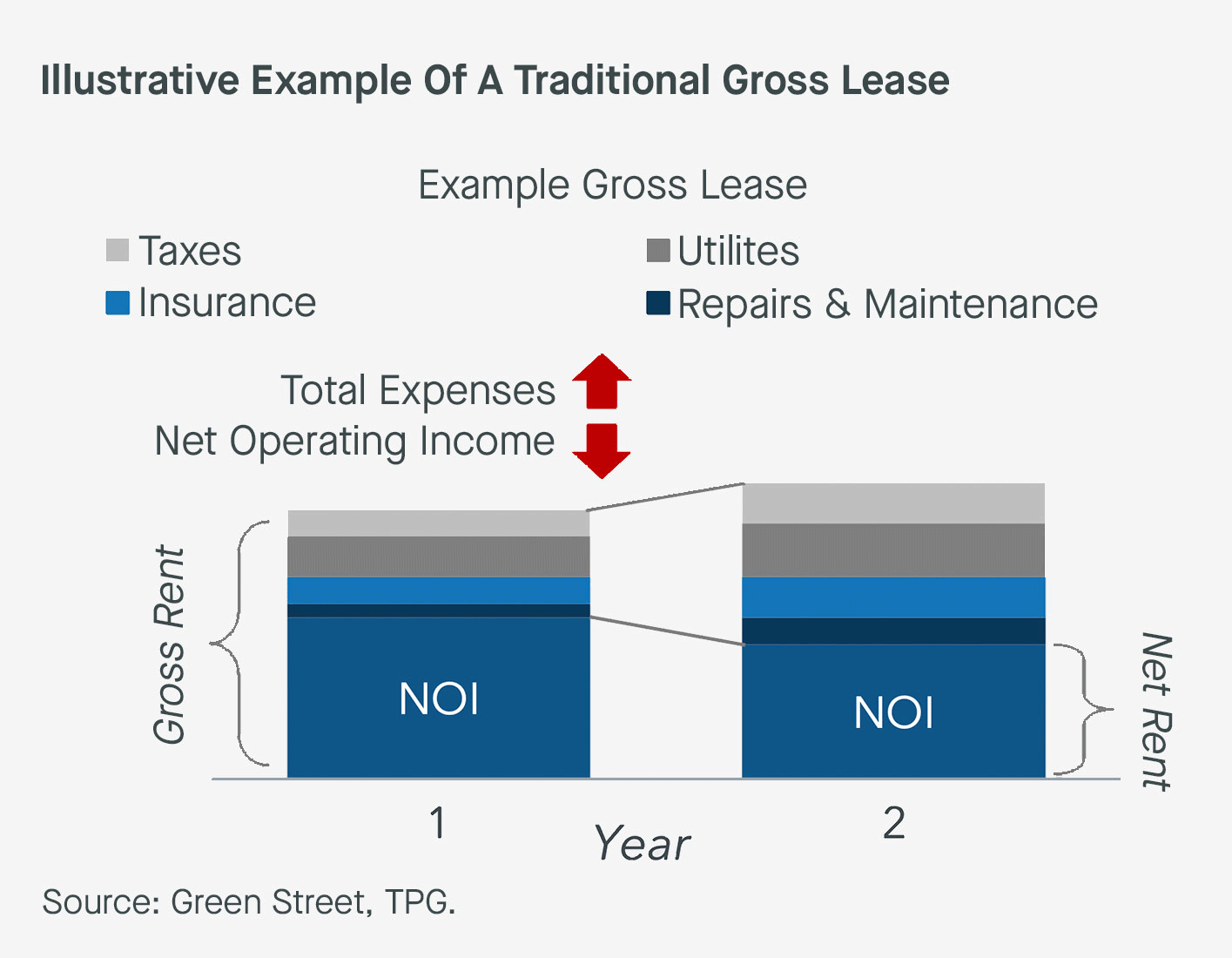

Unlike a gross lease, net leases require the tenant to bear the operating expenses associated with a property, such as taxes, insurance, utilities, repairs, and maintenance. Net leases therefore provide an inflation hedge given the owner doesn’t bear higher costs in an environment of rising operational expenses.

Exhibit 1: Net Lease Is Part Real Estate, Part Credit

What Differentiates Net Lease:

#1. Predictable & Increasing Cash Flows

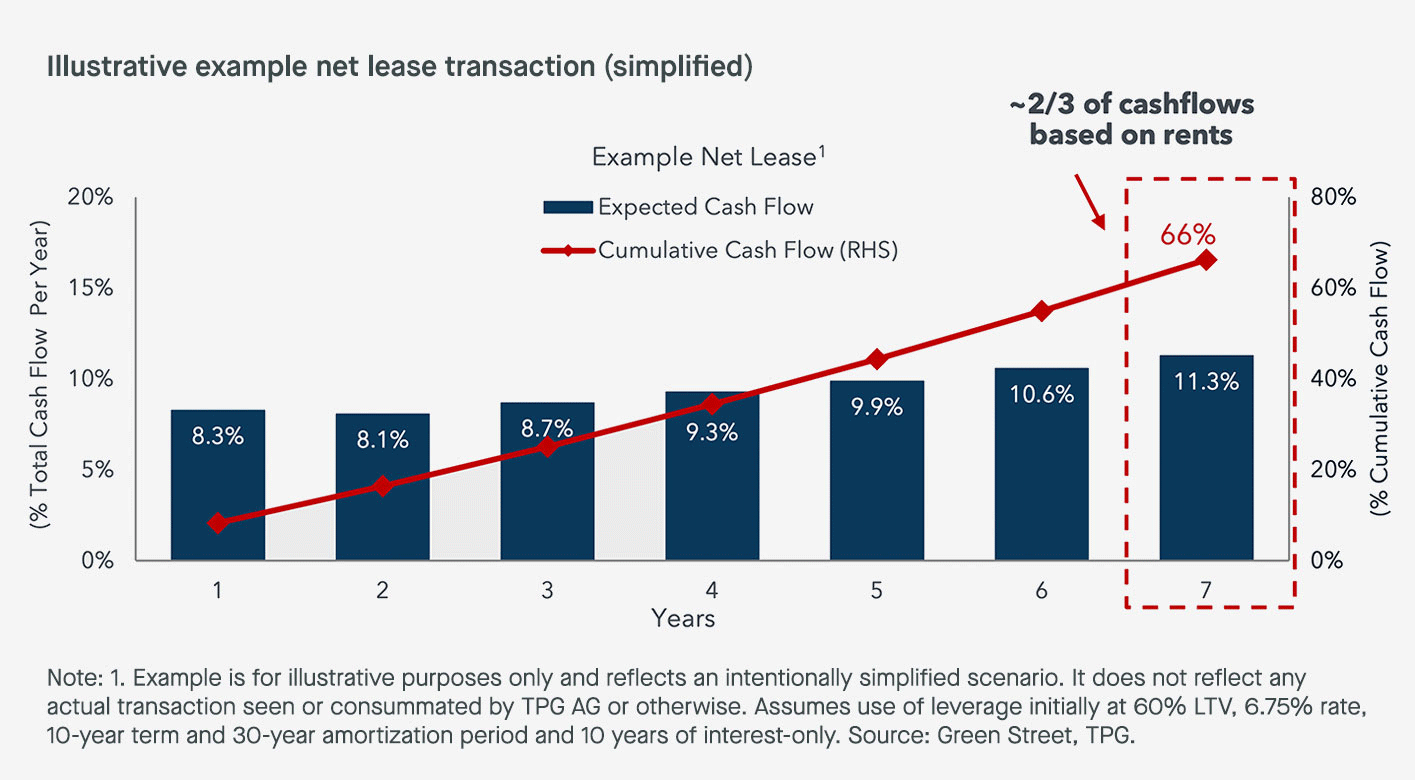

Net lease strategies can provide bond-like cash flows via rent payments that are contractually agreed upon with the tenant in advance. As the lessor, the long stream of contractual lease payments represents a series of bond-like coupons that often account for a significant portion of total investment returns (see Exhibit 2). This contrasts with most non-core real estate strategies where the majority of the cash flow can reside in a property’s residual value.

The recurring payments in a net lease are also usually subject to annual increases, providing inflation protection to the lessor and end investor. At the same time, the investment in a sale leaseback transaction is secured by the value of the acquired property, and the terminal value therefore reflects the attributes of the underlying asset, including property type, location, and tenant credit.

The relative importance of the recurring lease payments in net lease transactions means that good credit underwriting is critical. As the property owner in a net lease, you’re typically relying on a single tenant to provide regular, consistent cash flows via their lease payments. For investors, focusing on resilient businesses with mission-critical commercial real estate—such as logistics or warehouse property required for food or durable goods distribution—can provide advantageous downside protection relative to traditional credit strategies that are often unsecured.

Exhibit 2: Illustrative Net Lease Cash Flows

#2. Lower Sensitivity to Macro Volatility

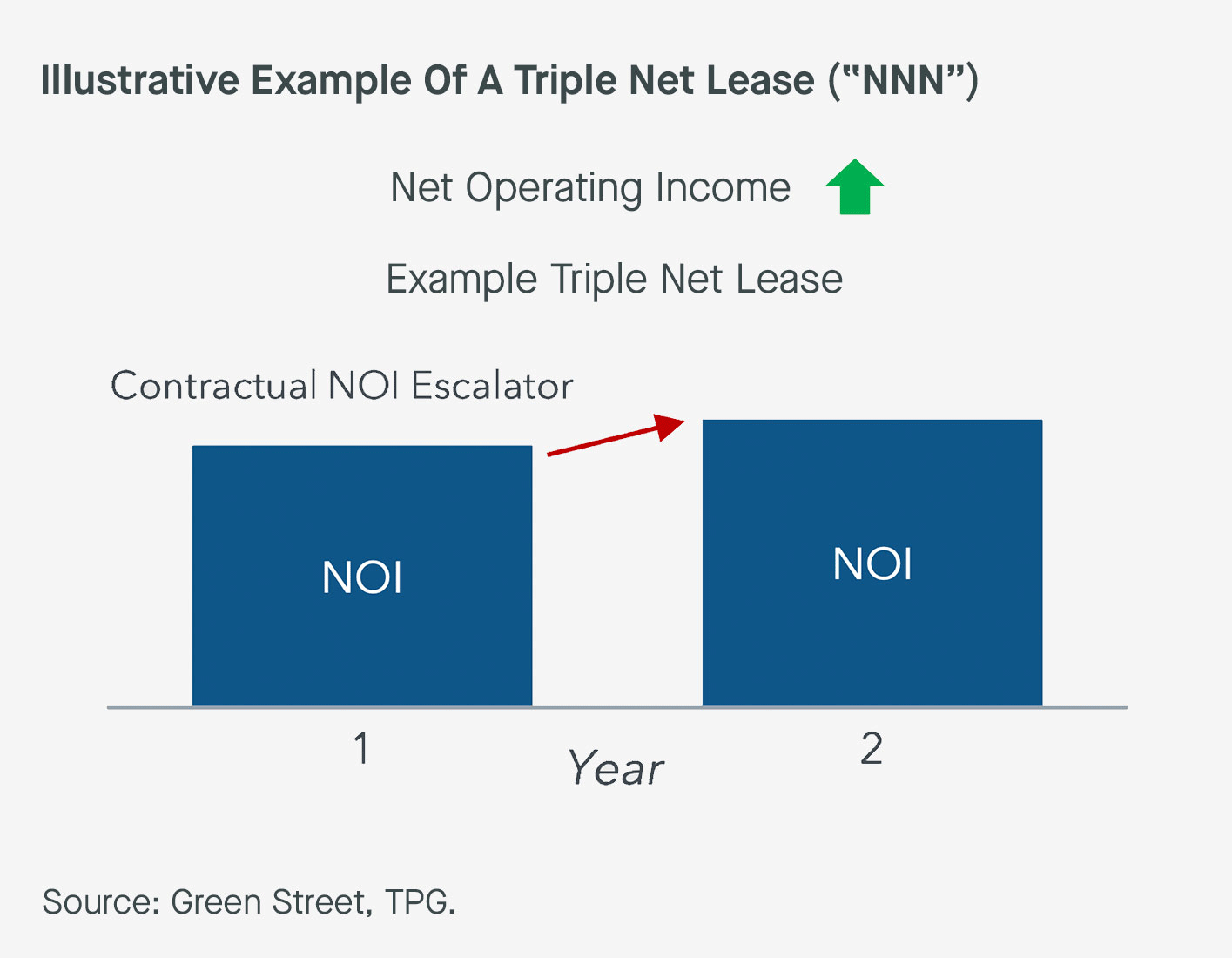

Beyond credit risk, net lease can also insulate investors from broader macroeconomic volatility. This is a byproduct of the fact that tenants in a triple net lease are responsible for paying all of the operating expenses associated with a property, contributing to less erosion in the lessor’s net operating income.

Such erosion can prove significant for gross lease rental properties (see Exhibit 3) particularly in inflationary environments, whereas net leases tend to have annual rent escalators that are contractually fixed or in some cases tied to CPI or other inflation indices.

Exhibit 3: Rising Expense Can Erode Operating Income In A Traditional Gross Lease…

Exhibit 3: …But Aren’t A Factor In A Triple Net Lease

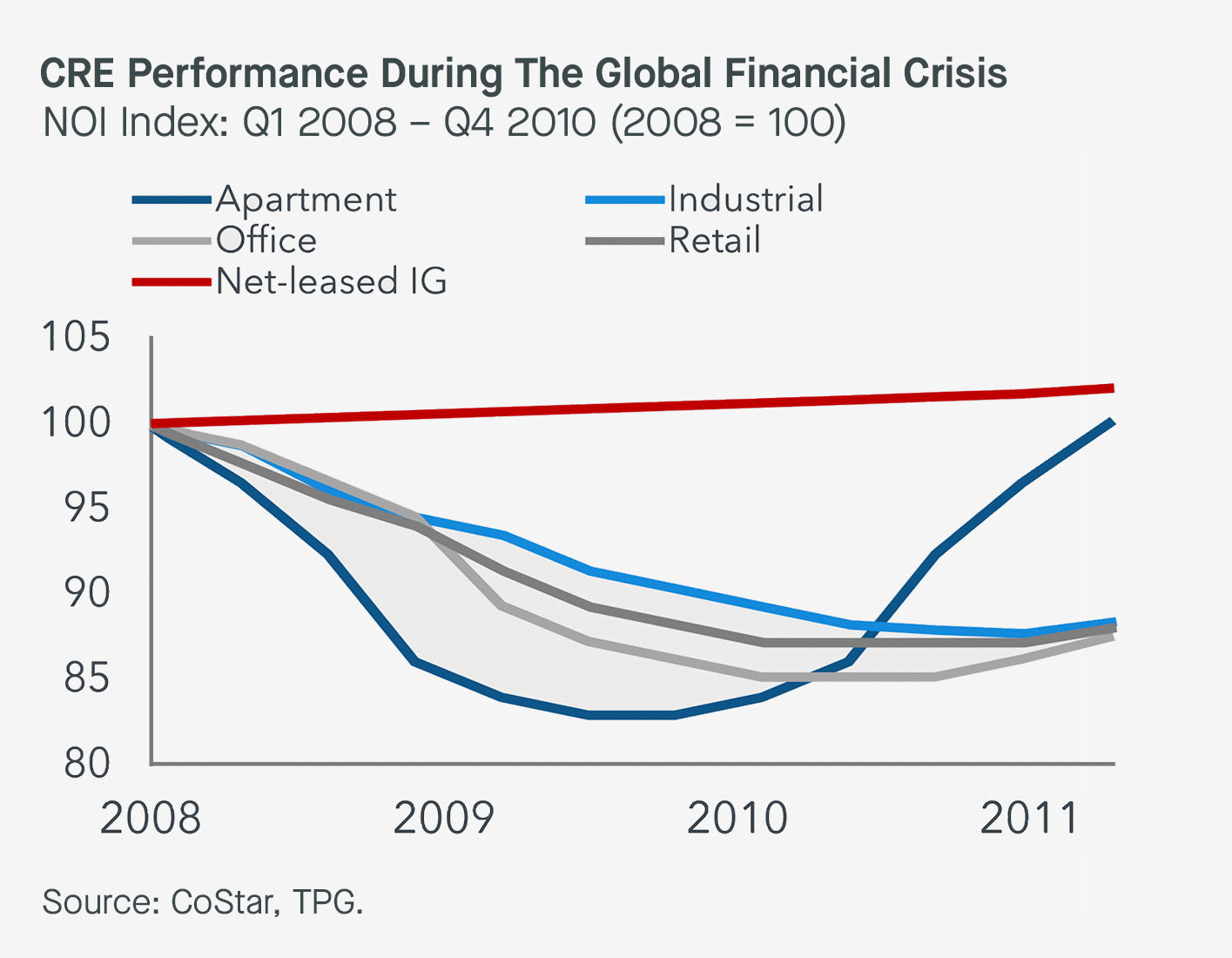

Identifying mission-critical assets for net leases can also make them more resilient to turnover or vacancy during economic downturns. During the Global Financial Crisis (GFC), for example, net lease outperformed other real estate segments and withstood some of the occupancy challenges seen elsewhere across commercial real estate markets (see Exhibit 4).

A similar dynamic of net lease resilience amid broader commercial real estate return dispersion has played out since the Covid pandemic. We believe net lease strategies can generate reliable, consistent income in almost any business environment given their usual long-term nature and contractual income escalators.

Exhibit 4: Net Lease During The GFC

#3. An Attractive Financing Solution For Corporates

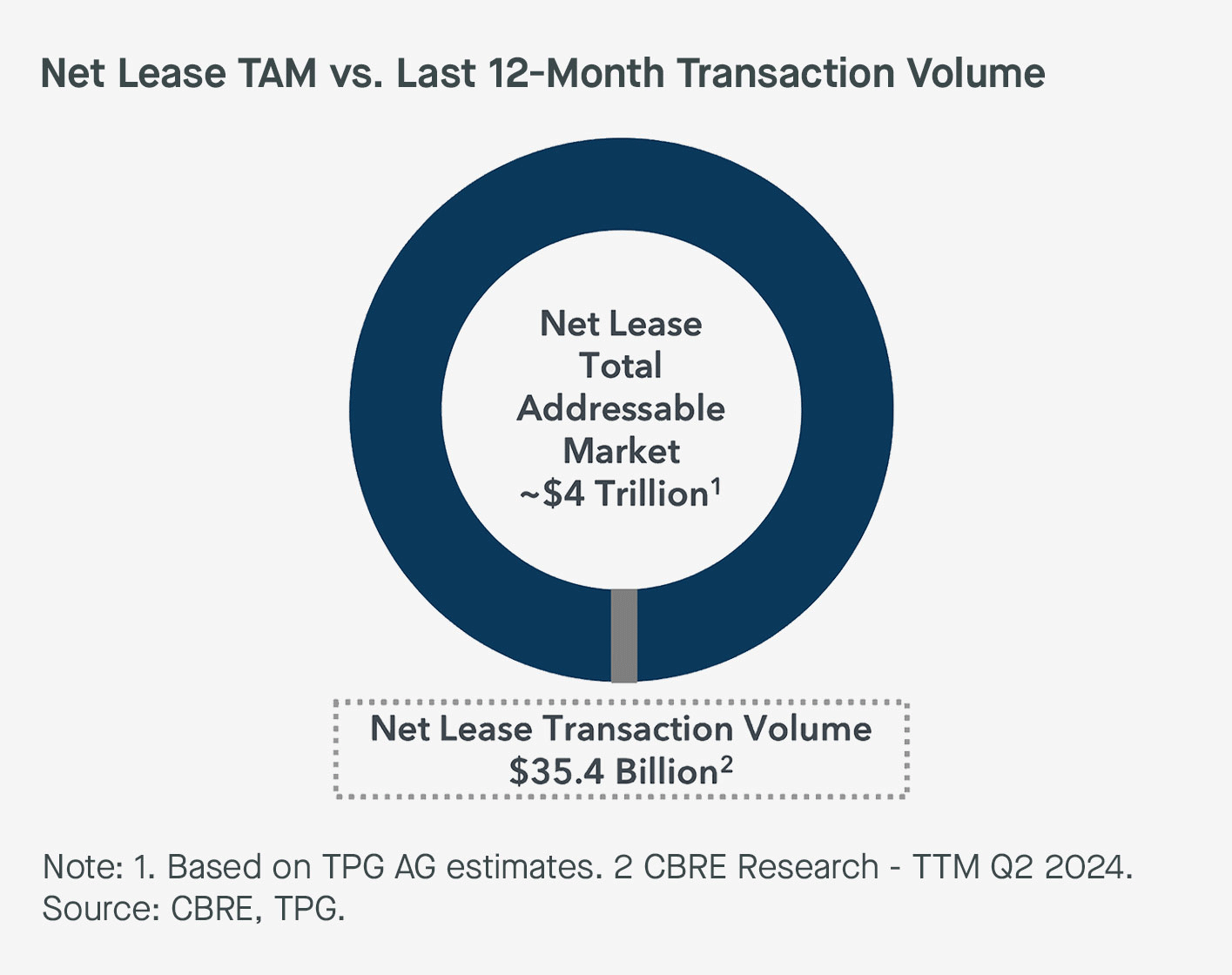

We believe the opportunity for net lease investing is set to grow over the next few years as many companies continue to look to refinance their balance sheets in the face of a sizable corporate debt maturity wall. The scale of the net lease opportunity is significant, in our view, as the volume of recent transactions is exceeded by the total addressable market of property owners who could be expected to engage in sale-leaseback transactions (see Exhibit 5).

Exhibit 5: We Believe The Vast Majority Of The Net Lease Market Remains Untapped

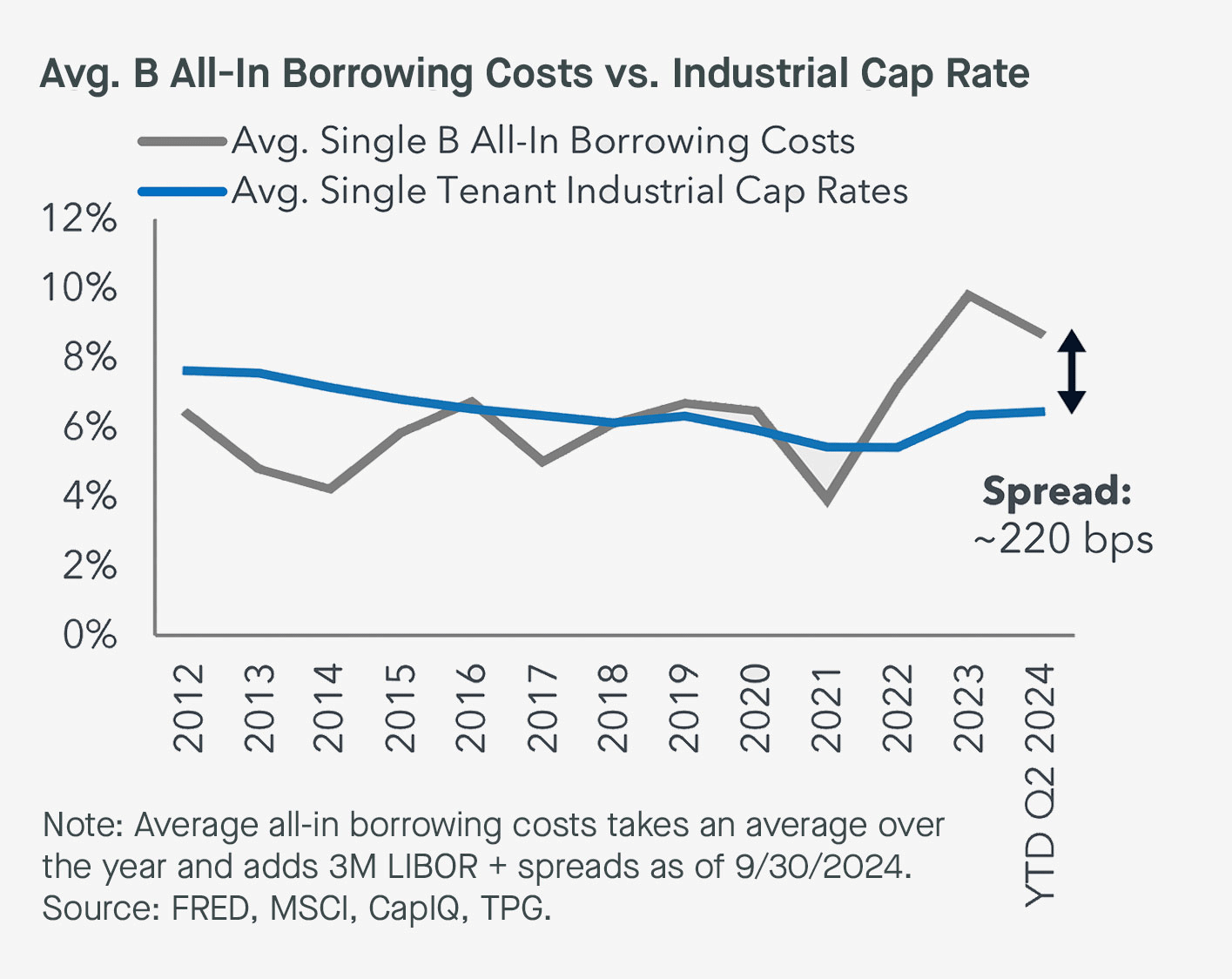

Even with more elevated cap rates today, sale-leasebacks can still often represent a more attractive refinancing tool for corporate borrowers relative to credit markets (see Exhibit 6).

Many property owners that engage in net lease transactions, such as the large universe of owner-occupied manufacturers in the US, also have more limited access to traditional funding sources, including bank-intermediated credit markets. In Europe, sale-leaseback volumes are still in an early growth stage, and between 60-75% of real estate is owner-occupied, which creates a highly target-rich environment for further growth in the years ahead.

Exhibit 6: Net Lease Remains An Attractive Source Of Capital For Many Borrowers

We also expect a pickup in M&A and broader market activity in 2025, which will increase demand for sale-leasebacks as companies—and private equity sponsor-backed companies in particular—look to free up space on their balance sheets to pursue strategic priorities. We believe this may provide a unique opportunity for net lease investors who are deeply familiar with the private equity landscape and maintain strong relationships across the industry.

#4. Reinforcing Secular Tailwinds

Over the long term, we expect three megatrends— increased onshoring, investment in supply chain resilience, and US re-industrialization—are going to reinforce the opportunity set. Companies’ focus on reshoring and building greater supply resilience was heightened by the Covid pandemic, and they remain important long-term priorities of corporate planning amid elevated global geopolitical uncertainty.

At the same time, rising domestic investment connected to the green transition has led to a renaissance in transition-related production and manufacturing, which will continue to require greater capital expenditure in new facilities. As companies make these new investments, it’s only natural that they will also seek to free up capital through sale-leasebacks to invest in other areas of growth.

Conclusion:

With credit spreads trading near historic tights, investors are understandably looking for attractive sources of risk-adjusted yield.

Net lease investors can provide capital at attractive terms to these companies, with upside potential in the form of possible property price appreciation and tenant credit improvement coupled with downside protection via the ownership of a physical property.

In our view, net lease investors can further benefit from strategic sourcing, careful credit selection, hands-on asset management, and robust transaction structuring.

A Few Key Net Lease Terms and Definitions:

Gross Lease: A lease where the landlord pays for all operating expenses, including property taxes, insurance, and utilities.

Double-Net Lease: A lease where the tenant isn’t responsible for all of the obligations. Typically, this relates to a property’s roof and building structure.

Triple-Net Lease: A lease where the tenant is responsible for all maintenance, capital expenditure, and all other obligations during the lease term.

Net Operating Income (NOI): Property-level income, prior to debt service. For a triple-net lease, NOI is equivalent to contractual rent.

Cap Rate: The ratio of contractual next twelve-month operating income produced by an asset and the purchase price of the asset.

Core Real Estate: High-quality properties typically providing steady cash flows.

Non Core Real Estate: Higher returning real estate strategies typically employing value-added approaches or repositioning real estate.

A Summary of Why We Like Net Lease:

#1. Predictable & Increasing Cash Flows

#2. Less Sensitivity to Macro Volatility

#3. An Attractive Financing Solution For Corporates

#4. Reinforcing Secular Tailwinds

Download Article

Disclosures

This white paper is provided for educational and informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. The contents hereof should not be construed as investment, legal, tax or other advice.

This white paper, including the information contained herein may not be copied, reproduced, republished, posted, transmitted, distributed, disseminated or disclosed, in whole or in part, to any other person in any way without the prior written consent of TPG Global, LLC (together with its affiliates, “TPG”).

Certain of the information contained herein, particularly in respect of market data, economic and other trends, forecasts and performance data, is from third-party sources. While TPG believes such sources to be reliable, TPG has not undertaken any independent review of such information.

Unless otherwise noted, statements contained in this white paper are based on current expectations, estimates, projections, opinions and beliefs of TPG professionals regarding general market activity, trends and outlook as of the date hereof. Such statements involve known and unknown risks and uncertainties, and undue reliance should not be placed thereon. Neither TPG nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein should be relied upon as a promise or representation as to past or future performance.

If you believe any content, branding, information or other material incorporated into this white paper has been included in violation of applicable law, agreement, or other restriction, or that any other portion of these materials is otherwise improper, please notify us at compliance@TPG.com.