Introduction

Since we issued our last report on co-investments in 2014, economic conditions and co-investment deal dynamics have changed markedly. Leverage is more expensive. Fundraising is slower. GPs are even keener to invite LPs to invest alongside them. Pre-signing opportunities are becoming the norm.

Yet despite these changes, the reasons to co-invest are fundamentally unchanged. Co-investments still deliver better risk-adjusted returns than their parent funds; they also grant LPs critical insights that can enhance their primary investment programs. It’s a small wonder that 50% of LPs want to be co-investors.

But with both supply and demand increasing, a new equilibrium has emerged. GPs place a premium on decisiveness and speed of execution, but not every LP is properly equipped. Moreover, the sheer velocity of certain deal processes means that some LPs can’t make an informed decision in the GP’s desired timeline. Despite a confluence of macroeconomic conditions and GP motivations driving increased co-investment deal flow, LPs may still question whether co-investments are worth it in today’s mile-a-minute marketplace.

We think they are.

To answer this question and to help LPs understand the market’s new competitive dynamics, we analyzed more than 1,700 private equity buyout co-investments (the Sample) completed by more than 145 GPs and 420 funds, which represent over US$340 billion of co-investment deal volume and serve as a proxy for the broader co-investment market.

State of the co-investment market

Deal volume

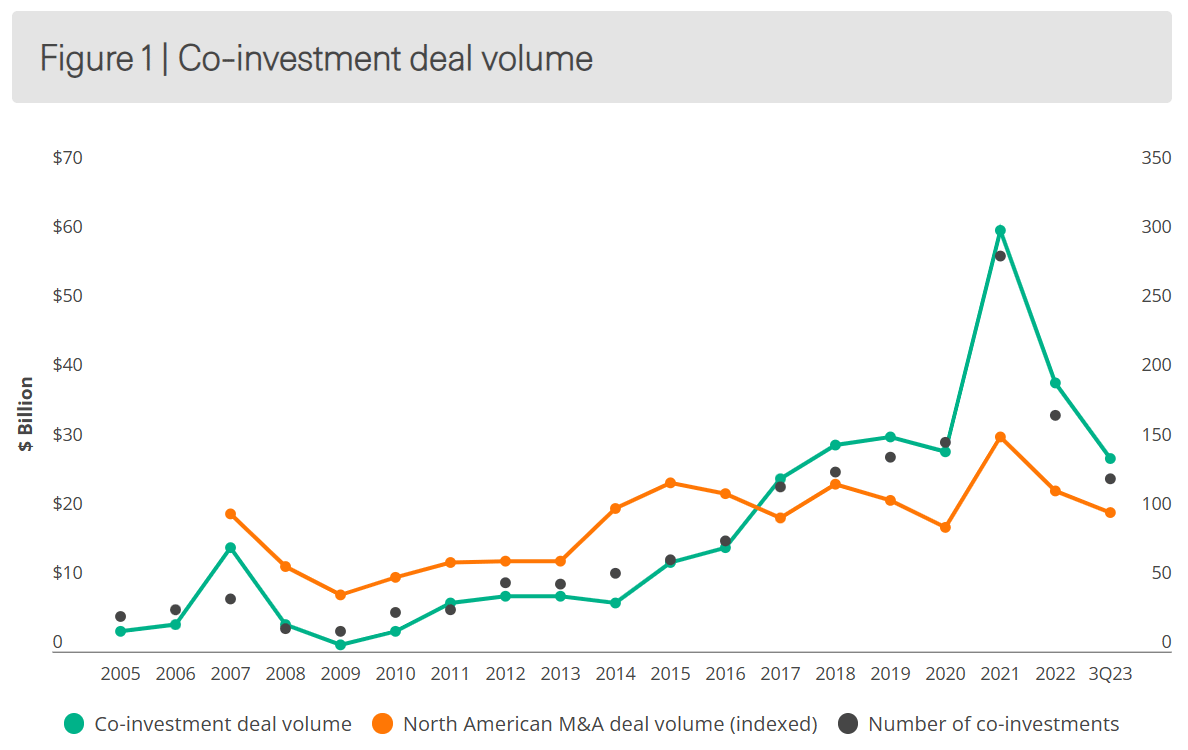

Since the early 2000s, co-investment deal volume has increased tenfold. After peaking just prior to the Global Financial Crisis (GFC), it took approximately 10 years for deal volume to recover. From 2017 through 2020, the market stabilized around $30 billion per year. However, it reached a new peak in 2021, when trillions of dollars of fiscal stimulus flooded the global economy, and a prolonged period of zero percent interest rates led to record levels of M&A activity and, correspondingly, co-investment volumes. While the market has partially normalized over the past few years, deal volume remains elevated by historical standards (Figure 1).

Source: StepStone co-investment survey, as of September 30, 2023. Includes buyout co-investments from 2005–2023. 2023 co-investment deal volume is annualized. North American M&A deal volume provided by PitchBook, as of December 31, 2023.

Read the full paper here