Opportunity to enhance fixed income allocations through diversification and yield optimization.

An Introduction to Private Rated Secured Lending, is your key to optimize your fixed income allocations. This in-depth guide provides you with a strategy to potentially enhance your investments and mitigate the risks associated with market volatility.

By diversifying your portfolio with private rated secured lending, you seek to gain access to an asset class that may offers stability, attractive yields, and reduced exposure to corporate credit.

Key Potential Benefits:

- Enhanced Stability: Discover how private rated secured lending can provide a stable income stream, shielding you from the ups and downs of the market.

- Potentially Attractive Yields: Uncover investment opportunities that could offer potentially higher yields compared to traditional fixed income instruments, allowing you to maximize your returns.

- Reduced Exposure to Corporate Credit: Diversify your portfolio and minimize the risks associated with overexposure to corporate credit, ensuring a more balanced and resilient investment strategy.

- Improve Risk-Adjusted Returns: Learn how private rated secured lending could help you achieve enhanced risk-adjusted returns.

- Expert Insights and Strategies: Benefit from the expertise of industry-leading professionals who will guide you through the intricacies of private rated secured lending, empowering you to make informed investment decisions.

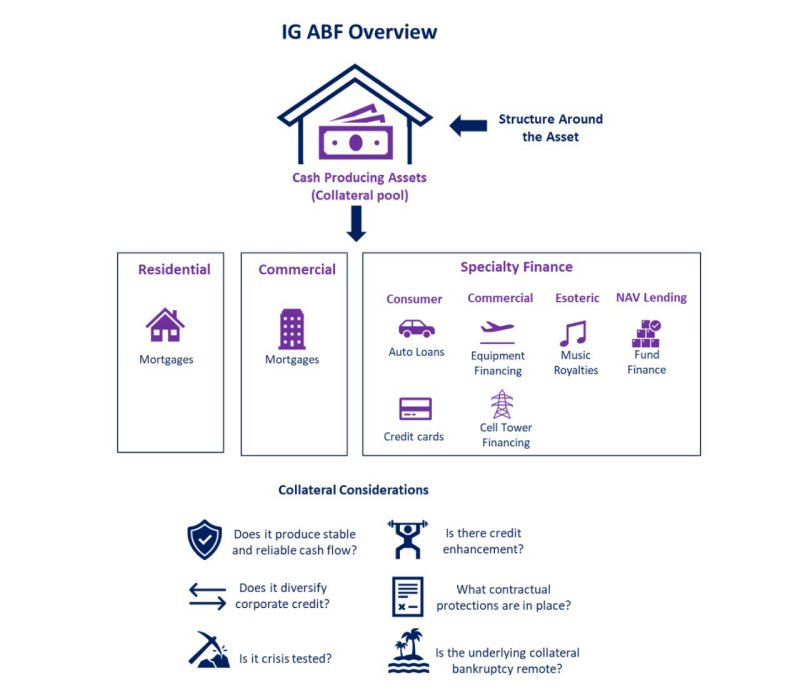

What is private investment grade asset-based finance?

Lending that is collateralized by distinct bankruptcy-remote pools of assets whose cash flows pay the principal and interest expected by bond holders and whose liquidation value proves a second layer of protection in case of default. In short, lending against specified and bankruptcy-remote collateral.

Any contractual cash flow can be collateralized, such as:

- Royalty payments

- Personal loans

- Auto loans

- Mortgages

- Accounts receivable

- Credit card receivables

These examples of individual contractual cash flows can be bundled together and lent against.

An overview of private investment grade asset-based finance

Download This Report