China has steadily been moving up global value chains, not just in capital goods but also in related IT and services.

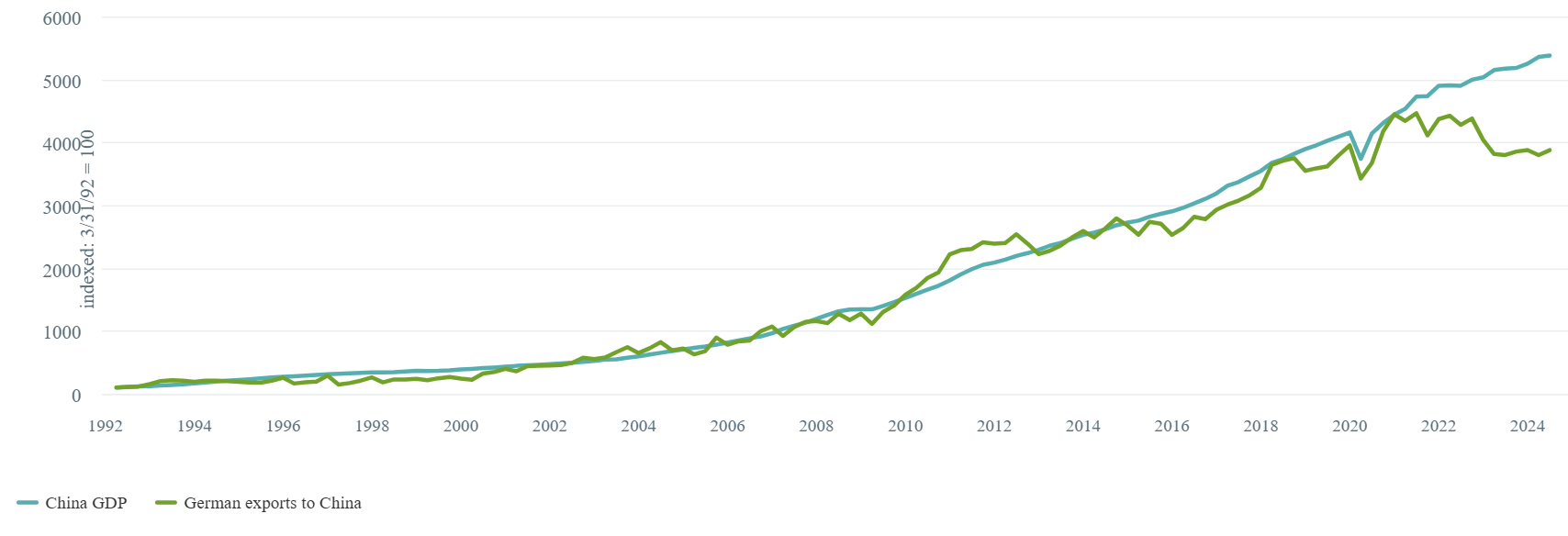

Recent weeks saw spectacular rises in Chinese equities before doubts returned amidst longstanding debates on the attractiveness of China’s stock market.[1] We want to zoom in on one factor especially important to international investors, namely how much recent stimulus measures will matter beyond Chinese shores. One good way to come to terms with this question is to consider German exports to China. As our Chart of the Week shows, these used to be tightly correlated with Chinese economic growth. Over the last five years, however, the two have become increasingly decoupled. The question now is, will the comprehensive stimulus program China has recently initiated give the Chinese economy such a strong boost that it might lead to improvements in the European Union (EU) export trends towards China? Unfortunately in our view, the short answer is no, for two reasons.

First, the break down in the relationship shown in the chart is a consequence of various structural trends. China’s import demand structure has changed because it has steadily been moving up global value chains, not just in capital goods but also in related IT and services. Instead of importing German capital goods, Chinese manufacturers have even turned into competitors. In the past, carmakers from Germany, the US and elsewhere took advantage of low production costs and cheap inputs to sell their expensive gas guzzlers both on the Chinese market and for export from there. Today, instead, China's low production costs are allowing its manufacturers to outperform foreign rivals in electric cars with sophisticated software.[2] The second reason for the broken-down relationship is that China not only imports fewer but also different goods, reflecting rapid increases in the importance of services and the new economy sectors.

Even if Chinese stimulus boosts growth, the boost to German exports is likely to be muted

Sources: Bloomberg Finance L.P. as of 10/15/24

So, will the latest Chinese stimulus program have enough of an impact on growth (and hence import demand) to benefit EU exporters (albeit less than before)? Unfortunately, probably not. The boldest part of the government plans is aimed at local government debt resolutions and improving their fiscal situation. (RMB) 6 trillion is expected to be spent on this over the next few years, transforming hidden local government debt into open debt and providing local governments with more funds to buy up excess housing stock. This is necessary to eventually return the sector to (modest) growth. “All these measures should have lasting positive effects,” argues Elke Speidel-Walz, Chief Economist Emerging Markets at DWS, “but to see them will take a while.”

There are also other measures announced to support in particular low/medium income of Chinese households via increasing their disposable income, by improving social security. However, this falls well short of what markets had hoped for, in particular a big boost to consumption via cheques to consumers. In conclusion, EU exporters are likely to derive only limited benefit from China's spending program and the decoupling between China's growth and EU exports mentioned above isn't likely to disappear any time soon.

1 The Economist, Oct. 14, 2024, Buttonwood: “Why investors should still avoid Chinese stocks: The debate about “uninvestibility” obscures something important.”

2 For further details, see our previous chart of the week, Chinese electric cars are in the fast lane (dws.com)

This information is subject to change at any time, based upon economic, market and other considerations and should not be construed as a recommendation. Past performance is not indicative of future returns. Forecasts are based on assumptions, estimates, opinions and hypothetical models that may prove to be incorrect. Alternative investments may be speculative and involve significant risks including illiquidity, heightened potential for loss and lack of transparency. Alternatives are not suitable for all clients.

Important information – North America

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries, such as DWS Distributors, Inc., which offers investment products, or DWS Investment Management Americas Inc. and RREEF America L.L.C., which offer advisory services.

This document has been prepared without consideration of the investment needs, objectives or financial circumstances of any investor. Before making an investment decision, investors need to consider, with or without the assistance of an investment adviser, whether the investments and strategies described or provided by DWS, are appropriate, in light of their particular investment needs, objectives and financial circumstances. Furthermore, this document is for information/discussion purposes only and does not and is not intended to constitute an offer, recommendation or solicitation to conclude a transaction or the basis for any contract to purchase or sell any security, or other instrument, or for DWS to enter into or arrange any type of transaction as a consequence of any information contained herein and should not be treated as giving investment advice. DWS, including its subsidiaries and affiliates, does not provide legal, tax or accounting advice. This communication was prepared solely in connection with the promotion or marketing, to the extent permitted by applicable law, of the transaction or matter addressed herein, and was not intended or written to be used, and cannot be relied upon, by any taxpayer for the purposes of avoiding any U.S. federal tax penalties. The recipient of this communication should seek advice from an independent tax advisor regarding any tax matters addressed herein based on its particular circumstances. Investments with DWS are not guaranteed, unless specified. Although information in this document has been obtained from sources believed to be reliable, we do not guarantee its accuracy, completeness or fairness, and it should not be relied upon as such. All opinions and estimates herein, including forecast returns, reflect our judgment on the date of this report, are subject to change without notice and involve a number of assumptions which may not prove valid.

Investments are subject to various risks, including market fluctuations, regulatory change, counterparty risk, possible delays in repayment and loss of income and principal invested. The value of investments can fall as well as rise and you may not recover the amount originally invested at any point in time. Further-more, substantial fluctuations of the value of the investment are possible even over short periods of time. Further, investment in international markets can be affected by a host of factors, including political or social conditions, diplomatic relations, limitations or removal of funds or assets or imposition of (or change in) exchange control or tax regulations in such markets. Additionally, investments denominated in an alternative currency will be subject to currency risk, changes in exchange rates which may have an adverse effect on the value, price or income of the investment. This document does not identify all the risks (direct and indirect) or other considerations which might be material to you when entering into a transaction. The terms of an investment may be exclusively subject to the detailed provisions, including risk considerations, contained in the Offering Documents. When making an investment decision, you should rely on the final documentation relating to the investment and not the summary contained in this document.

This publication contains forward looking statements. Forward looking statements include, but are not limited to assumptions, estimates, projections, opinions, models and hypothetical performance analysis. The forward looking statements expressed constitute the author’s judgment as of the date of this material. Forward looking statements involve significant elements of subjective judgments and analyses and changes thereto and/or consideration of different or additional factors could have a material impact on the results indicated. Therefore, actual results may vary, perhaps materially, from the results contained herein. No representation or warranty is made by DWS as to the reasonableness or completeness of such forward looking statements or to any other financial information contained herein. We assume no responsibility to advise the recipients of this document with regard to changes in our views.

No assurance can be given that any investment described herein would yield favorable investment results or that the investment objectives will be achieved. Any securities or financial instruments presented herein are not insured by the Federal Deposit Insurance Corporation (“FDIC”) unless specifically noted, and are not guaranteed by or obligations of DWS or its affiliates. We or our affiliates or persons associated with us may act upon or use material in this report prior to publication. DB may engage in transactions in a manner inconsistent with the views discussed herein. Opinions expressed herein may differ from the opinions expressed by departments or other divisions or affiliates of DWS. This document may not be reproduced or circulated without our written authority. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries. This document is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, including the United States, where such distribution, publication, availability or use would be contrary to law or regulation or which would subject DWS to any registration or licensing requirement within such jurisdiction not currently met within such jurisdiction. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions.

Past performance is no guarantee of future results; nothing contained herein shall constitute any representation or warranty as to future performance. Further information is available upon investor’s request. All third party data (such as MSCI, S&P & Bloomberg) are copyrighted by and proprietary to the provider.

For Investors in Canada: No securities commission or similar authority in Canada hasi reviewed or in any way passed upon this document or the merits of the securities described herein and any representation to the contrary is an offence. This document is intended for discussion purposes only and does not create any legally binding obligations on the part of DWS Group. Without limitation, this document does not constitute an offer, an invitation to offer or a recommendation to enter into any transaction. When making an investment decision, you should rely solely on the final documentation relating to the transaction you are considering, and not the information contained herein. DWS Group is not acting as your financial adviser or in any other fiduciary capacity with respect to any transaction presented to you. Any transaction(s) or products(s) mentioned herein may not be appropriate for all investors and before entering into any transaction you should take steps to ensure that you fully understand such transaction(s) and have made an independent assessment of the appropriateness of the transaction(s) in the light of your own objectives and circumstances, including the possible risks and benefits of entering into such transaction. You should also consider seeking advice from your own advisers in making this assessment. If you decide to enter into a transaction with DWS Group you do so in reliance on your own judgment. The information contained in this document is based on material we believe to be reliable; however, we do not represent that it is accurate, current, complete, or error free. Assumptions, estimates and opinions contained in this document constitute our judgment as of the date of the document and are subject to change without notice. Any projections are based on a number of assumptions as to market conditions and there can be no guarantee that any projected results will be achieved. Past performance is not a guarantee of future results. The distribution of this document and availability of these products and services in certain jurisdictions may be restricted by law. You may not distribute this document, in whole or in part, without our express written permission.

For investors in Bermuda: This is not an offering of securities or interests in any product. Such securities may be offered or sold in Bermuda only in compliance with the provisions of the Investment Business Act of 2003 of Bermuda which regulates the sale of securities in Bermuda. Additionally, non-Bermudian persons (including companies) may not carry on or engage in any trade or business in Bermuda unless such persons are permitted to do so under applicable Bermuda legislation.

© 2024 DWS Investment GmbH, Mainzer Landstraße 11-17, 60329 Frankfurt am Main, Germany.

All rights reserved.

DWS Investment GmbH, as of 10/15/24; 082245_174 (10/2024) (10/2025)