Key Takeaways

- Supply Gluts: Perfect growing conditions can lead to an oversupply, causing a drop in crop prices and profits.

- Drought’s Silver Lining: Sector-level crop receipts and average incomes tend to rise during periods of drought.

- Financial Management: Droughts heighten the risk and reward of crop production, making sound financial management essential.

Executive Summary

Rain makes grain, and in 2024, crop growers in the U.S. received plenty of it. When agricultural commodities become too abundant, prices decline alongside sector profitability. Although drought conditions pose considerable challenges, they also create notable opportunities for U.S. crop producers, making it a potentially more favorable environment to operate in.

Inelastic Demand Meets Supply Fluctuations

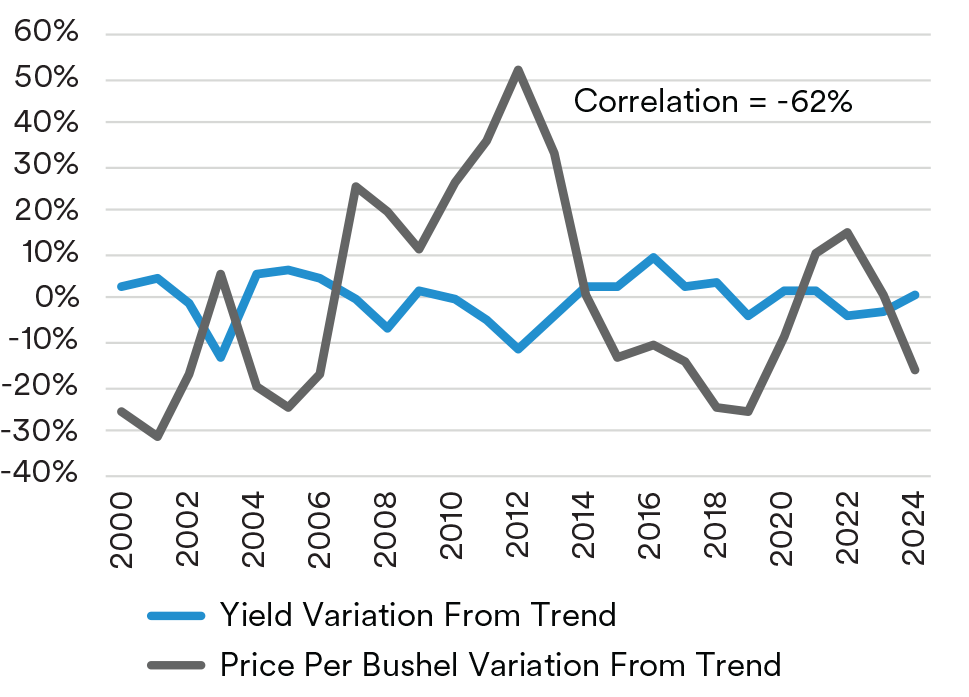

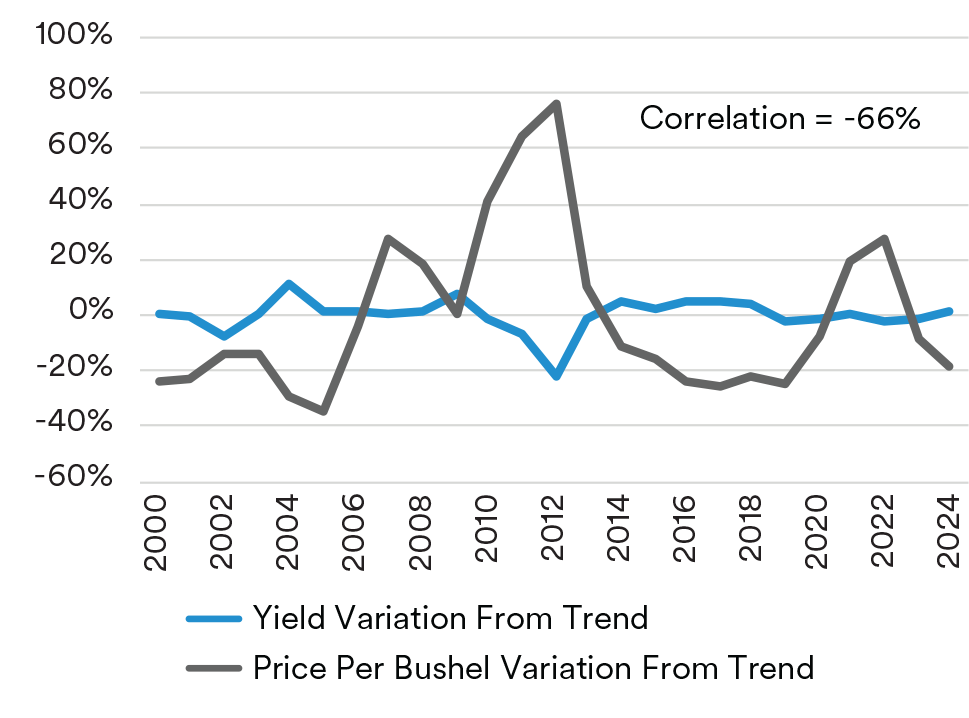

Paradoxically, one of the least desirable market conditions for U.S. crop producers is having ideal growing conditions and fantastic yields, leading to an oversupply that depresses prices and reduces profits. This is precisely what happened in 2024 as week-after-week crop conditions improved and yield expectations increased. The only way out of this situation, short of a miraculous increase in demand, is aggressive marketing to clear the stocks, which because most agricultural commodities can be stored for some time, could take multiple years. On the other hand, a reduction in sector-level yields and production, such as that experienced from 2010 to 2013 due to drought across much of North America, is a much more appealing market environment for growers. Due to the inelastic demand for most agricultural commodities1, a modest reduction in supply results in a disproportionately large increase in prices, as is evident when comparing fluctuations in yields and prices of corn and soybeans (Exhibit 1 and Exhibit 2). This outsized price response means that industry revenues actually increase when overall production declines. Of course, an even more profitable outcome is when a competitor around the world is the one reducing production.

Exhibit 1 | Supply Fluctuations Drive Prices (Soybeans)

Source: MIM, USDA, 2024

Exhibit 2 | Supply Fluctuations Drive Prices (Corn)

Source: MIM, USDA, 2024

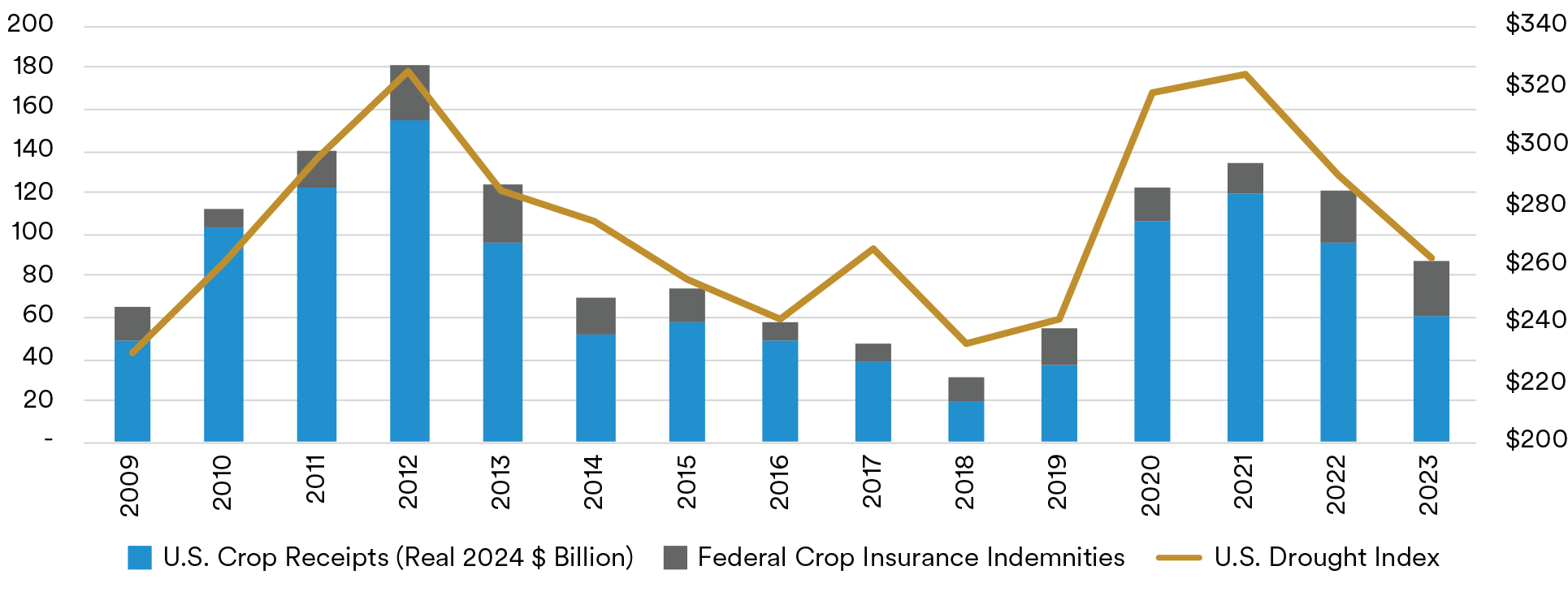

Impacts of Drought

Because prices of most agricultural commodities respond so disproportionately to modest reductions in production, drought has historically been associated with higher sector-level crop revenues (Exhibit 3). As weather patterns shift and drought potentially becomes more common, U.S. producers could benefit — provided they employ sound financial management strategies. In any given year, producers affected by drought would likely be compensated by federal crop insurance and other farm support programs, while those not affected will benefit from higher market prices. This dynamic leads to higher industry incomes and increasing land values driven by elevated average profits. Over time, all producers can benefit from higher average prices, incomes and land values, as long as they can endure the wait for drought conditions to move on to a new area, and then they can take their turn producing at higher prices.

It’s important to note that these impacts differ in the long run and the short run. If production were to decline for too long, then consumers of crops, particularly livestock producers, would adapt and respond to their higher costs by limiting the size of their herds/flocks/etc. — and reduce the overall demand for crops. So, the benefits of drought on crop profits are not necessarily due to the reduction in yields and production, but instead due to volatility in yields and production.

Exhibit 3 | Drought and Crop Revenues

Source: MIM, USDA, National Drought Mitigation Center, 2024

Managing Volatility and Uncertainty

However, the benefits of higher prices and incomes come at a cost. More volatile weather results in more volatile incomes. To capitalize on higher average prices and incomes, producers must endure the highs and lows of the market. Effective financial management becomes increasingly important in this context. Building a healthy balance sheet and smartly utilizing leverage to maintain adequate working capital are crucial for any producer aiming to survive poor years and thrive in better ones. In such an environment, a relationship with a lender who is going to be there throughout cycles of the agricultural economy to provide necessary capital becomes a crucial tool.

Future Impacts of Changing Weather Patterns

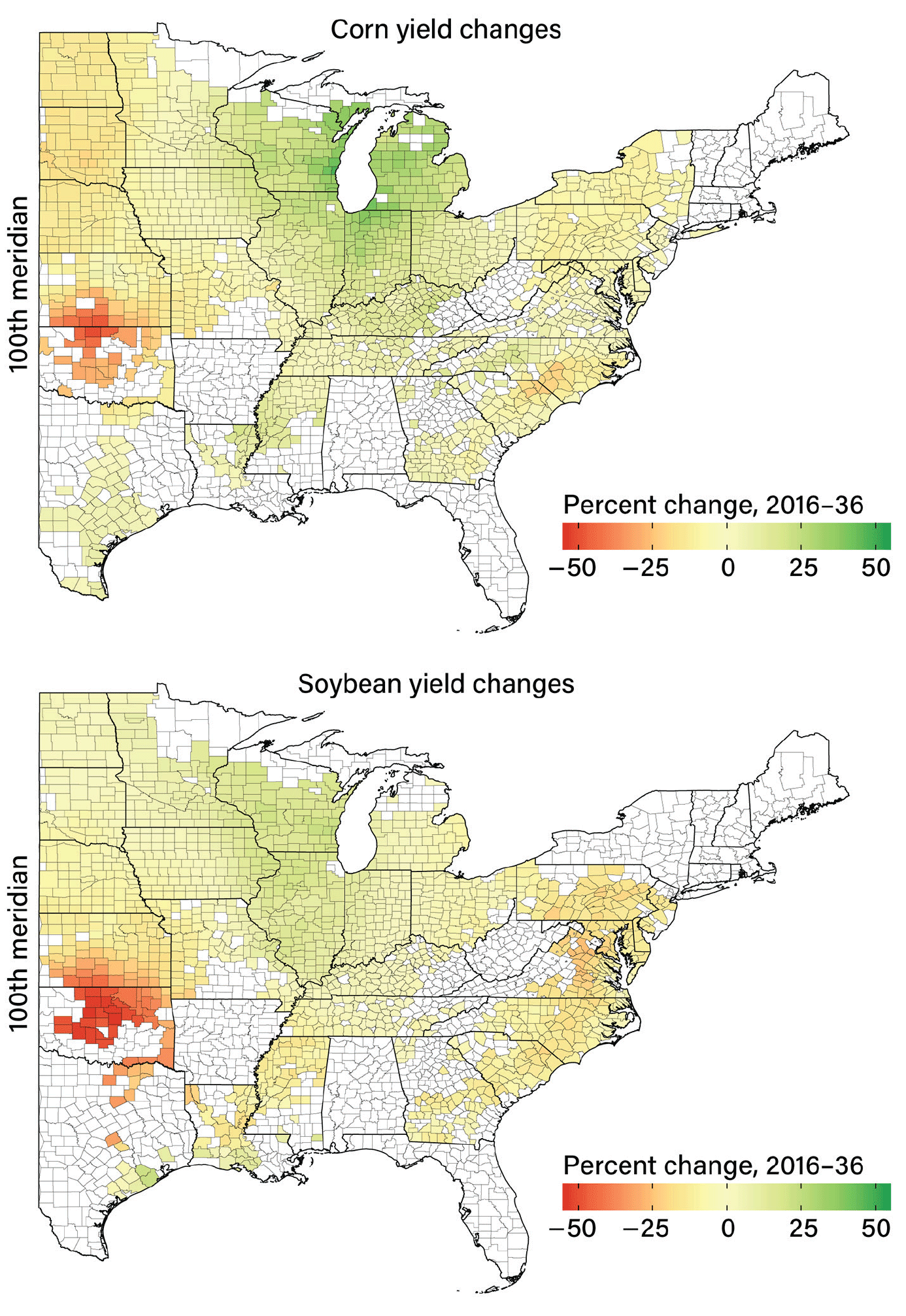

Small producers are likely unable to have the financial fortitude to survive a multi-year drought hovering over their land. Agriculture in the U.S. has a long history of consolidation, and an increased prevalence of drought would only increase the synergies and efficiencies unlocked by consolidating and geographically diversifying. Most scientists believe that the U.S. at large will continue to warm throughout the century, and as weather patterns are expected to be more volatile, floods, droughts and tropical storms will become more commonplace2. The USDA has studied how corn and soybean yields may be affected by changes in precipitation and temperature3 (Exhibit 4). In the Midwest, the impacts on crop yields are expected to differ depending on how close the farmland is to the Great Lakes, with areas closer to the Great Lakes experiencing higher increases in yields.

Exhibit 4 | Climate-Linked Yield Changes Projected To Vary by Region and by Crop

Source: USDA ERS, USDA NASS, 2024

Conclusion

When weather is good and farmers produce too much, no one can escape lower prices. While drought conditions present significant challenges, they also offer substantial opportunities for U.S. crop producers because of the disproportionate increase in prices associated with modest declines in production, and drought becomes especially desirable when it’s located in a competing nation in another hemisphere. By maintaining robust financial management practices, producers can navigate the risks and reap the rewards of drought conditions.

Endnotes

1 Roberts, Michael J., and Wolfram Schlenker. 2013. “Identifying Supply and Demand Elasticities of Agricultural Commodities: Implications for the US Ethanol Mandate.” American Economic Review, 103 (6): 2265–95.

2 Fifth National Climate Assessment (globalchange.gov) Jay, A.K., A.R. Crimmins, C.W. Avery, T.A. Dahl, R.S. Dodder, B.D. Hamlington, A. Lustig, K. Marvel, P.A. Méndez-Lazaro, M.S. Osler, A. Terando, E.S. Weeks, and A. Zycherman, 2023: Ch. 1. Overview: Understanding risks, impacts, and responses. In: Fifth National Climate Assessment. Crimmins, A.R., C.W. Avery, D.R. Easterling, K.E. Kunkel, B.C. Stewart, and T.K. Maycock, Eds. U.S. Global Change Research Program, Washington, DC, US

3 Beckman, J., Ivanic, M., & Nava, N. J (2023). Estimating Market Implications From Corn and Soybean Yields Under Climate Change in the United States (Report No. ERR-324). U.S. Department of Agriculture, Economic Research Service.

Download Article

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein.

This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

1. As of June 30, 2024, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/ third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd, MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.