The fifth topic in this series highlights the potential opportunities offered to retail investors by the opening up of private markets, in infrastructure, among other things.

The world needs huge amounts of infrastructure investment to propel the energy transition and battle climate change and to upgrade digital infrastructure. Private as well as public in-vestment will be needed. And retail investors can now become involved as the capital market democratizes and opens up fresh opportunities to them.

Infrastructure is a booming asset class. Its inherent value has been highlighted by the prolonged period of high Inflation and the recent Volatility in equity and bond markets. Infrastructure is essential to the economy and our daily lives and can offer returns that are less dependent on economic cycles than other asset classes. In addition, the significantly longer investment horizon could be providing stability in a volatile market environment. Long-term structural trends and a high level of pent-up demand should continue to support infrastructure investment in the years and decades ahead. The world is changing, and the need for infrastructure investment is being driven by the energy transition, and not only that. The European Union estimates that EUR 1.5 trillion per year will be needed to meet its net-zero emissions target by 2050.[1] Major upgrades to digital infrastructure are also required; fiber broadband, mobile masts and data centers must be set up.

Retail investors can become involved. The European Union has developed European Long-Term Investment Funds (ELTIFs) to ensure that infrastructure projects (as well as other comparable investment opportunities in what has been a largely private capital market) receive a greater inflow of investor funds. ELTIFs were first authorized in 2015 and were generally considered a failure, with the very restrictive nature of the original regulation a problem. However, in 2023, ELTIF 2.0 introduced some very important, investor-friendly changes that have led to a surge in issuance and marketing.

Retail investors support growth of private markets

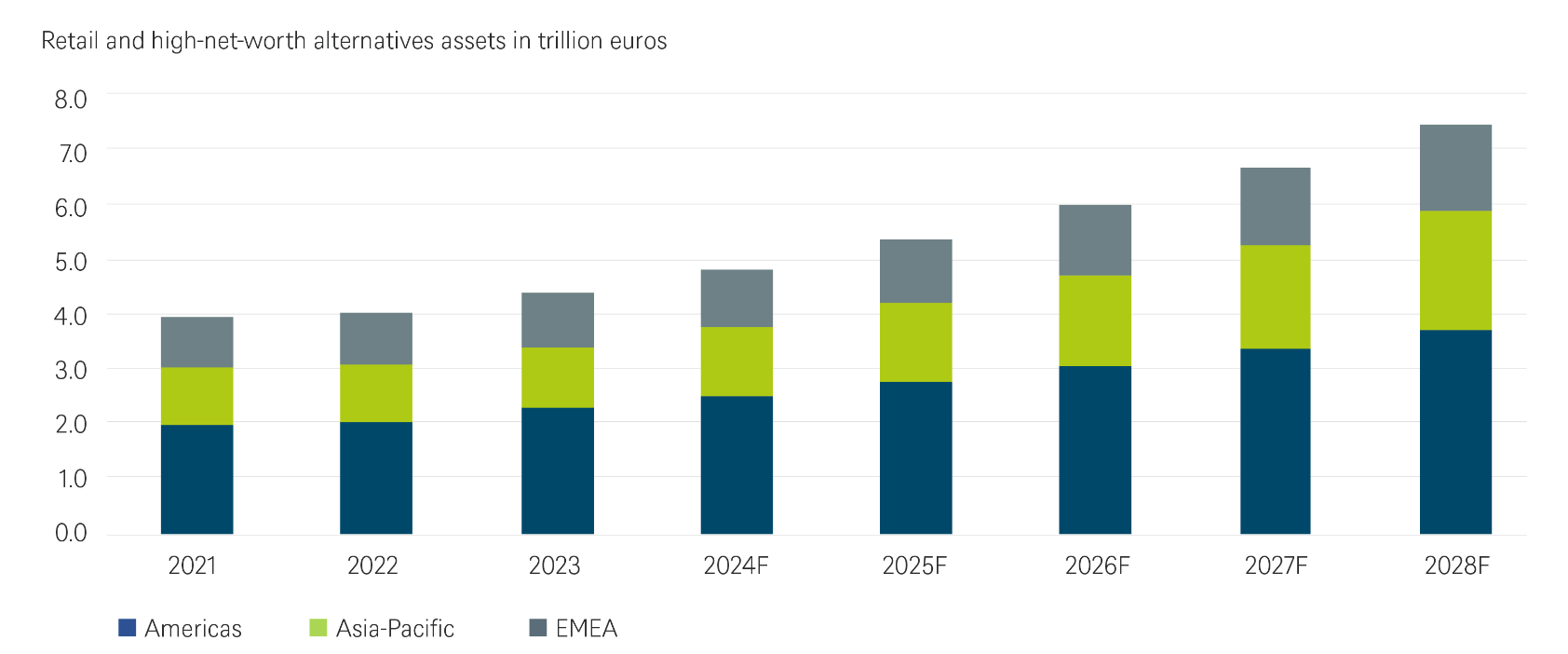

Sources: McKinsey, DWS Investment GmbH as of 10/10/24.

Retail investors should, however, be aware of the long-term nature of these investments, which typically run for at least 10 years. Furthermore, despite the use of terminology such as "semi-liquid," we believe that these products should generally be classified as illiquid, especially compared to public-market products. On the other hand, they offer portfolio construction advantages previously reserved to institutional investors.

Democratization of the capital market is likely to continue dynamically. “From a product-structuring perspective, ELTIFs are just scratching the surface,” says Annie Del-Giudice, Senior Principal for Alternatives Strategy at DWS. “They are developing rapidly but local products also remain in high demand.” An increase in the number of Long-Term Asset Funds (LTAFs) from the UK, the Spanish version of Real Estate Investment Trust (REIT) (Sociedades Anónimas Cotizadas de Inversión Inmobiliaria, SOCIMIs) and newer innovations such as private-credit ETFs reflect efforts to open up the private capital market to a wider range of investors. In the U.S., there are also a number of products that are designed to do just that. The U.S. Securities and Exchange Commission (SEC) recognized years ago that “given the decline in the number of public companies, achieving true diversification without an allocation to private markets is difficult.”[2]

These markets are not only growing but also developing, particularly in their investor structure. The assets that retail investors and high-net-worth individuals invest in the private capital market are expected to grow to just under €7.5 trillion by 2028, an increase of more than €3 trillion.[3] This is a welcome development that should help the net-zero and digital transformation of the economy – and, for investors, provide scope for asset diversification.

Download Article

1 EU needs trillions of investment for 2050 climate target, Reuters as of 1/29/24

2 Expanding Retail Access to Private Markets, SEC as of November 2019

3 Global Growth Cube, McKinsey as of September 2024

This information is subject to change at any time, based upon economic, market and other considerations and should not be construed as a recommendation. Past performance is not indicative of future returns. Forecasts are based on assumptions, estimates, opinions and hypothetical models that may prove to be incorrect. Alternative investments may be speculative and involve significant risks including illiquidity, heightened potential for loss and lack of transparency. Alternatives are not suitable for all clients.

Important information – North America

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries, such as DWS Distributors, Inc., which offers investment products, or DWS Investment Management Americas Inc. and RREEF America L.L.C., which offer advisory services.

This document has been prepared without consideration of the investment needs, objectives or financial circumstances of any investor. Before making an investment decision, investors need to consider, with or without the assistance of an investment adviser, whether the investments and strategies described or provided by DWS, are appropriate, in light of their particular investment needs, objectives and financial circumstances. Furthermore, this document is for information/discussion purposes only and does not and is not intended to constitute an offer, recommendation or solicitation to conclude a transaction or the basis for any contract to purchase or sell any security, or other instrument, or for DWS to enter into or arrange any type of transaction as a consequence of any information contained herein and should not be treated as giving investment advice. DWS, including its subsidiaries and affiliates, does not provide legal, tax or accounting advice. This communication was prepared solely in connection with the promotion or marketing, to the extent permitted by applicable law, of the transaction or matter addressed herein, and was not intended or written to be used, and cannot be relied upon, by any taxpayer for the purposes of avoiding any U.S. federal tax penalties. The recipient of this communication should seek advice from an independent tax advisor regarding any tax matters addressed herein based on its particular circumstances. Investments with DWS are not guaranteed, unless specified. Although information in this document has been obtained from sources believed to be reliable, we do not guarantee its accuracy, completeness or fairness, and it should not be relied upon as such. All opinions and estimates herein, including forecast returns, reflect our judgment on the date of this report, are subject to change without notice and involve a number of assumptions which may not prove valid.

Investments are subject to various risks, including market fluctuations, regulatory change, counterparty risk, possible delays in repayment and loss of income and principal invested. The value of investments can fall as well as rise and you may not recover the amount originally invested at any point in time. Further-more, substantial fluctuations of the value of the investment are possible even over short periods of time. Further, investment in international markets can be affected by a host of factors, including political or social conditions, diplomatic relations, limitations or removal of funds or assets or imposition of (or change in) exchange control or tax regulations in such markets. Additionally, investments denominated in an alternative currency will be subject to currency risk, changes in exchange rates which may have an adverse effect on the value, price or income of the investment. This document does not identify all the risks (direct and indirect) or other considerations which might be material to you when entering into a transaction. The terms of an investment may be exclusively subject to the detailed provisions, including risk considerations, contained in the Offering Documents. When making an investment decision, you should rely on the final documentation relating to the investment and not the summary contained in this document.

This publication contains forward looking statements. Forward looking statements include, but are not limited to assumptions, estimates, projections, opinions, models and hypothetical performance analysis. The forward looking statements expressed constitute the author’s judgment as of the date of this material. Forward looking statements involve significant elements of subjective judgments and analyses and changes thereto and/or consideration of different or additional factors could have a material impact on the results indicated. Therefore, actual results may vary, perhaps materially, from the results contained herein. No representation or warranty is made by DWS as to the reasonableness or completeness of such forward looking statements or to any other financial information contained herein. We assume no responsibility to advise the recipients of this document with regard to changes in our views.

No assurance can be given that any investment described herein would yield favorable investment results or that the investment objectives will be achieved. Any securities or financial instruments presented herein are not insured by the Federal Deposit Insurance Corporation (“FDIC”) unless specifically noted, and are not guaranteed by or obligations of DWS or its affiliates. We or our affiliates or persons associated with us may act upon or use material in this report prior to publication. DB may engage in transactions in a manner inconsistent with the views discussed herein. Opinions expressed herein may differ from the opinions expressed by departments or other divisions or affiliates of DWS. This document may not be reproduced or circulated without our written authority. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries. This document is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, including the United States, where such distribution, publication, availability or use would be contrary to law or regulation or which would subject DWS to any registration or licensing requirement within such jurisdiction not currently met within such jurisdiction. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions.

Past performance is no guarantee of future results; nothing contained herein shall constitute any representation or warranty as to future performance. Further information is available upon investor’s request. All third party data (such as MSCI, S&P & Bloomberg) are copyrighted by and proprietary to the provider.

For Investors in Canada: No securities commission or similar authority in Canada hasi reviewed or in any way passed upon this document or the merits of the securities described herein and any representation to the contrary is an offence. This document is intended for discussion purposes only and does not create any legally binding obligations on the part of DWS Group. Without limitation, this document does not constitute an offer, an invitation to offer or a recommendation to enter into any transaction. When making an investment decision, you should rely solely on the final documentation relating to the transaction you are considering, and not the information contained herein. DWS Group is not acting as your financial adviser or in any other fiduciary capacity with respect to any transaction presented to you. Any transaction(s) or products(s) mentioned herein may not be appropriate for all investors and before entering into any transaction you should take steps to ensure that you fully understand such transaction(s) and have made an independent assessment of the appropriateness of the transaction(s) in the light of your own objectives and circumstances, including the possible risks and benefits of entering into such transaction. You should also consider seeking advice from your own advisers in making this assessment. If you decide to enter into a transaction with DWS Group you do so in reliance on your own judgment. The information contained in this document is based on material we believe to be reliable; however, we do not represent that it is accurate, current, complete, or error free. Assumptions, estimates and opinions contained in this document constitute our judgment as of the date of the document and are subject to change without notice. Any projections are based on a number of assumptions as to market conditions and there can be no guarantee that any projected results will be achieved. Past performance is not a guarantee of future results. The distribution of this document and availability of these products and services in certain jurisdictions may be restricted by law. You may not distribute this document, in whole or in part, without our express written permission.

For investors in Bermuda: This is not an offering of securities or interests in any product. Such securities may be offered or sold in Bermuda only in compliance with the provisions of the Investment Business Act of 2003 of Bermuda which regulates the sale of securities in Bermuda. Additionally, non-Bermudian persons (including companies) may not carry on or engage in any trade or business in Bermuda unless such persons are permitted to do so under applicable Bermuda legislation.

© 2024 DWS Investment GmbH, Mainzer Landstraße 11-17, 60329 Frankfurt am Main, Germany.

All rights reserved.

DWS Investment GmbH, as of 10/10/24; 103097_1 (10/2024) (10/2025)